Do we understand how people want to get paid in retirement?

Yesterday I wrote about the American 401K system and the risks taken by people who become too cautious as they become older. The value judgements implicit in the report were based on “received ideas” about how markets operate , established by those in the financial markets.

But an equally valid argument might build from the bottom up. Social marketing organisations build propositions based not on what people should do, but on what people do. This gives people the products they want (but maybe not what they need).

In the market in which I work, the buzzword is “freedom”, the budget pension reforms are proving very popular in concept, though the question now is “what do you do with your freedom?”.

Since the Budget, the Government has introduced what looks like another pension freedom- one that allows schemes to be set up to meet the needs of people and companies.

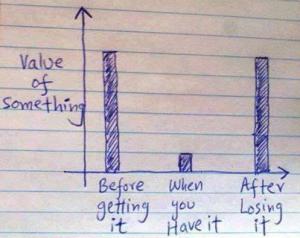

While it is easy to define what people don’t want (in this case annuities), it’s not so easy to define what they do.

We are not the first country to grapple with how to organise pensions to meet the collective need of a large part of the population. Here is an extract from an article from ATP (the parent of NOW pensions) explaining how it was going to organise a “New Model Guaranteeing a higher ATP Pension for all Danes”

The article was written in 2008

Anders Grosen and Mogens Steffensen both emphasise that the current major issue of debate in the world of insurance and pensions is whether guarantees should be issued at all:

»Products with built in guarantees may not be issued

10 or 20 years from now,« says Mogens Steffensen.Grosen agrees: »But if you want a model with guarantees, this is the way to do it,« he says.

»The decision of whether or not to apply guarantees is indeed a political one.

Furthermore, it is one that involves consideration as to the role of the scheme in question in the wider multipillared

old age protection system and as to the distribution of risk between individuals and the pension provider.Understanding the distribution of risks is at the heart of it all

In the Danish model, the link between State and Private pensions is bridged by ATP which is a state owned provider operating a monopoly on second pillar pensions.

To suggest that the Danish CDC model could simply be reconstructed in Britain ignores the existing pension architecture and ignores the wishes of the people who it would be aimed for.

As Steffensen and Grosen says, what ATP delivers by way of risk and return evolves from what people need and that is decided in part by what people have got.

In the UK we have a steadily strengthening Basic State Pension, DC savings are increasing while DB rights are decreasing. The appetite to guarantee pensions from employers is decreasing and the appetite to purchase guaranteed annuities appears much less than annuity sales figures would suppose.

The Government cannot stand by and allow the market to reform since the market is currently unable to deliver certain options – specifically collective pension solutions that do require little or no employer sponsorship. This is why there is going to be legislation- the Government decides what doors are open and what doors are shut.

But while Government can open doors , it cannot build all the solutions. That is a job to be shared with the financial services industry.

And while the financial services industry can build the shopping mall but the shops themselves will be built around people’s needs and wants.

We do not seem very interested in finding out what people’s needs and wants are.

But it’s not hard to ask…

“Would you be prepared to take a pay-cut in return for a job for life?”

“How much of you pay would have to be basic, how much performance related?”

“Would you work for an employer if you thought it might go bust?”

We’ve got get used to thinking about our income at work in these terms; these are the questions people should be asking themselves in retirement.

We are changing the way we get paid to work

The UK population is proving incredibly flexible in the way it is adapting to change. More and more people are going self-employed, many are prepared to work zero hours contracts, traditional 9 to 5 working is becoming less frequent.

We are changing the way we look at work and how we expect to get paid.

The same will happen when we stop or reduce our working time in later years.

Now is the time for a great national debate on how we want to organise our income in later life and that debate needs to be organised both by those in Government and by those in the pensions industry.

We are changing the way we get paid to stop work

It is time to get people thinking and discussing their future and we should be using the data that comes from those discussions to shape the future of the products we offer.

The tools to get this debate under way are with us. We have ways to talk and collect data that were unimaginable a few years ago. The postbox has been replaced by the send button on our phones and tablets, we are able to participate while sitting on a bus or waiting at the hairdresser.

If we really want to engage Britain in a debate about funding for our later life, we need a proper centralised platform for debate. I urge the political parties as they prepare their manifestos for 2015 to consider including this debate in their deliverables.

This post was first published in http://www.pensionplaypen.com/top-thinking

Great post. I was checking continuously this blog and I’m impressed!

Extremely useful info particularly the last part 🙂 I care for such information much.

I was seeking this particular info for a long time.

Thank you and good luck.

Howdy this is kinda of off topic but I was wondering

if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience.

Any help would be greatly appreciated!

Thank you for the good writeup. It in fact

was a amusement account it. Look advanced to far added

agreeable from you! However, how could we communicate?

I’ve been surfing online more than 4 hours today,

yet I never found any interesting article like yours. It is pretty worth enough for me.

In my view, if all site owners and bloggers made good content as you did,

the internet will be a lot more useful than ever

before.

Article writing is also a excitement, if you be acquainted with afterward you can write otherwise it is difficult to

write.