There is a crack in everything , that’s how the light gets in

TPR’s Corporate Plan for the next three years is for the most part solid and uncontroversial. Where it extends beyond the 2020 plan is in a long section on value for money which I have quoted in full below. The pensions industry has yet to get the message but “value for money” now informs every aspect of the Government’s DC agenda. Put another way, if a measure does not improve value for the saver, what is it’s point?

Thankfully the artificial and divisive phrase “value for members” has been dropped and it is clear that where tPR speaks , they speak with the FCA. It looks like what will come out of CP20/9 (the FCA’s VFM consultation) will be a discussion paper published shortly by both regulators

As someone who has pioneered the benchmarking of performance and the scoring of value for money, I am encouraged by the statement

Our exploratory work around value for money will include considering the merits and practicalities of a common, cross-industry standard and the development of benchmarks

This standardization is long overdue. The over-elaborate value for money frameworks established by IGCs and Trustees are so diverse they provide no means of comparison and the saver has no idea what value he/she has actually had.

Reference is made to the DWP’s work on “improving member outcomes” which I understand will be providing us with more detailed guidance next month. It is absolutely right that the focus of improvements is on the outcomes of members, too much talk to date has been about the characteristics of a good DC scheme and too little on what such schemes have provided by way of pounds in their saver’s pockets.

As such a saver, I want to know who has provided value and make informed choices based on evidence. The longer-term work coming out of the FCA/TPR discussion paper is focused on the saver and focused on “cross-industry” standards, this is absolutely right.

Here is what TPR is saying , I have emboldened those statements and headings that I consider particularly important and I’d welcome comment.

Value for money

We believe savers’ money must be suitably invested, costs and charges must be reasonable and good quality services and administration are provided to all.

Savers in DB schemes have the promise of a certain level of income at retirement. However, significantly more people are saving into DC schemes where the retirement income amount is dependent on the level of contributions and the performance of investments – as well as the decisions made on approaching retirement by the saver.

Value for money was one of two priority areas in our joint strategy with the FCA published in October 2018. We will be using our powers to help drive value for money for savers and this includes setting and enforcing clear standards and principles where relevant.

Our research indicates that smaller DC schemes are often less able to meet standards of good governance and administration. The economy of scale of bigger schemes often means savers will benefit in a variety of ways, and therefore we encourage consolidation as a means of improving saver outcomes. Further to the introduction of the regulations from October this year, we will seek to ensure that schemes consolidate where they are unable to achieve value for money.

Savers are also less likely to receive good value for money when they have multiple small pots with varying performance and charging structures. Improved saver engagement through tools such as the Pensions Dashboards could help to address these issues in the longer term by putting the saver in control of consolidating their savings. However, there is more that industry can do now to address the existing stock of small pots and to prevent the problem continuing, and we support the DWP’s Small Pension Pots Working Group.

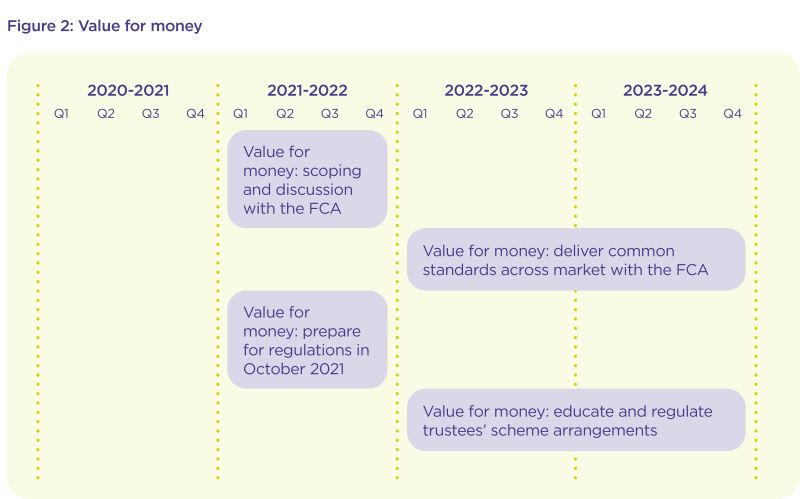

Figure 2 below depicts an activity timings plan for the work under Value for money. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

A focus on developing a broader understanding of value for money

In year 1, we will increase our focus on this strategic priority, developing a broader understanding of value for money: its components, risks, and opportunities. This development will build on our current joint work with the FCA and ongoing dialogue with government.

Our exploratory work around value for money will include considering the merits and practicalities of a common, cross-industry standard and the development of benchmarks and we will publish a joint discussion paper with the FCA. We believe value for money assessments will be key to ensuring DC pensions deliver the best possible retirement outcomes for savers, and we have been guided by our stakeholders and industry on the importance of this work.

Following the DWP’s 2019 consultation ‘Improving outcomes for members of DC pension schemes’, regulations in relation to value for money assessments and consolidation of smaller DC schemes will come into force in October 2021. Statutory guidance in this area will be updated to help trustees and advisers ensure they understand what is required of them and that they are able to take the necessary action to comply with the law.

Years 2 and 3 (2022-23 and 2023-24) Continuing to work with trustees and our regulatory partners to establish cross-industry standards

During years 2 and 3, we will continue to work with the FCA to deliver common standards across the market. This will follow the joint discussion paper with the FCA on value for money, which invites discussion from the industry but does not set out a finalised framework. Clear, cross-industry standards would help drive positive change, particularly in the context of a smaller number of DC occupational schemes with large numbers of savers.

Continuing our work from year 1, we will work with trustees so they can assess value for money in relation to their scheme, and in accordance with the regulations.

Following this morning’s report in the Today programme of the widespread use of Latin among senior civil service mandarins, I realised the mistake I have been making all these years when addressing the Pensions Regulator.

For those of us living more plebian existences, I have supplied an English translation.

Valorem pecunia

(Value for Money)

Ideo considerare oportet quid sit quaeritur: Quid enim est de valore pecunia pro pensionibus moderator est?

(The question we should be asking is: What is the value for money of the Pensions Regulator?)

Eorum se sumptibus patet: £ CXI million. Nostrae obsequium sumptibus sunt a pluribus de hoc.

(Their direct costs are clear £111 million. Our compliance costs are a multiple of this.)

Quid enim?

(For what?)

6% augmentum in sumptibus: si tantum mihi pensionem habebat augeri, quantum.

(A 6% increase in costs – if only my pension had risen by that.)

Et eorum responsio ad DB codice consulendum est moratus donec 2022

(And their response to the DB funding code consultation is delayed until 2022)

Debent teneri ad rationem proprie

(They should be held to account properly.)

Post of the year!