These men are looking out for you

Here is my advice – don’t worry – people are looking out for you.

If you have sent your options form and have not heard back, do not worry. There is no need to panic, don’t send more option forms, it will make things worse for the administration teams!

If you have yet to send in your options form and can get a photocopy, keep the copy and send the original this weekend.

If you are worried about the decision you have made, here is Paul’s advice (and it’s mine too).

STEELWORKERS

General advice and help: The Pensions Advisory Service British Steel helpline 020 7932 9522

To stop a transfer you’ve begun: British Steel Pension Scheme (BSPS) helpline 0800 085 7264

Make complaint about a financial adviser: Financial Ombudsman Service 0800 023 4567— Paul Lewis (@paullewismoney) December 16, 2017

And for more general help on Time to Choose.

If you’re a pensioner, phone 0808 168 8709 (or +44 (0) 1206 585 361 if you’re calling from outside the UK).

If you’re not a pensioner, phone 0800 085 7264 (or +44 (0) 113 823 1344 if you’re calling from outside the UK).

Send in your form whatever!

Even if you want to go to the PPF, it’s worth sending in your form – it’s not worth leaving things to chance.

Note the wording on the form, so long as you’ve sent back your form by 22nd December, so don’t despair about the Christmas post and give up next week.

If you are worried about all the different deadlines…

This info-graphic may help – you might want to copy and print it and put it on a noticeboard;

If you are worried about your existing adviser…

You may be advised by one of the six companies that have “chosen” to stop taking business. They are…

Stockton-on-tees-based Vintage Investment Services, Barnsley-based Retirement & Pension Planning Services Ltd, and Carmarthenshire-based West Wales Financial Services Ltd have all agreed to ‘cease all DB pension transfer business immediately.

They join Active Wealth Management, Mansion House and Pembrokeshire Mortgage Services.

You can find out what these firms can do by going to the FCA website; this useful screengrab, prepared by Stefan Zait, shows you how to get to the adviser you are interested in.

If you are still not clear, you can ring the FCA helpline on 0800 111 6768.…

Vintage Investment Services has issued this guidance

Members should get a letter from Vintage confirming that

1) Any application to transfer that has been submitted should complete over the coming weeks;…

2) They can continue to provide other services such as advice on Pension Plan and Investments;

3) They are undertaking an internal review but cannot say when this will complete and when they hope to recind the voluntary requirement.

You need to talk to them about what happens if your application to transfer has not been submitted and discuss your options.

Speak to CHIVE if you need a new adviser.

If you are with advised by one of these firms then you could speak to Chive which has resource on the ground and is saving BSPS members a lot of anxiety.

Chive is a group of Financial Advisers who have given up their time to sort problems out on the ground. I’ve been asked about advisers outside of South Wales who have capacity. The Chive advisers have been selected and are monitored by Al Rush and they will give you the kind of hands on help that only people who do the job for a living can do.

Al is generating a list of people who have been advised on transferring and feel they may have been mis-sold. I can vouch for Al, this is not going to be sold to ambulance chasers, you may want to put your name down by following the link

You can also contact Chive by emailing Al at advice@yourwealthcare.co.uk . I have seen Al’s inbox and it is not a pretty sight. But Al is tireless and he will get back to you or pass you on to someone who can help.

Can you broadcast this message?

If you want to speak to me, I am happy to talk to anyone who can get the message to a wider audience. We need responsible reporting and I’m happy to put reporters in touch with the key representatives of the members – the people who run the Facebook Groups, monitor changes to the Time to Choose website and speak with the BSPS scheme management.

I can be called on 07785 377768

I can be mailed at henry.tapper@pensionplaypen.com

DM me at twitter ; @henryhtapper

I will take calls from BSPS members but I am not a regulated adviser and can give you limited help- beyond what is on this blog.

Don’t know what the fuss is about?

Call to action from MP Chris Smith –Steelworkers need support as pension deadline looms

A cautionary tale from Paul.

Listen to You and Yours (from minute 33)

Brilliant introduction and smart comment from Allan Johnson +

Megan Butler gets her act together

Watch the work and pensions select committee on BSPS (13/12/17)

The full two hour watch broken into sections 1)steelworkers + 2) trustees+ 3)Regulator

If you’re really keen – the full transcript is available here – together with submissions.

Some not very complimentary comment on some of the witnesses contributions

Daily Mail comment on the work and pensions select committee hearing

And finally – keep smiling!

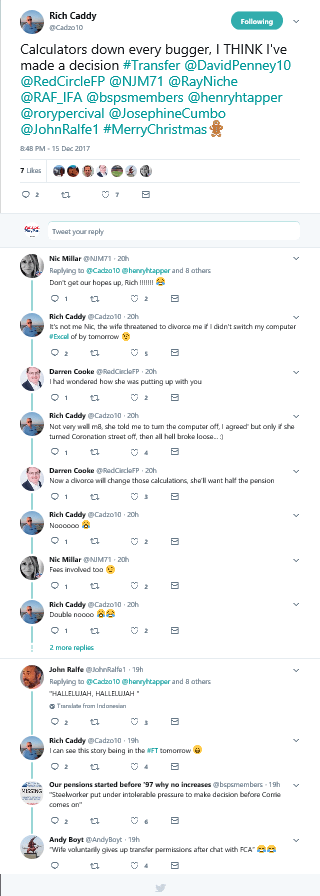

ON ALL CHANNELS: pic.twitter.com/I5PHBufb5z

— Our pensions started before ’97 why no increases (@bspsmembers) December 15, 2017

https://platform.twitter.com/widgets.js

And he’s written the book

Your infographic with the timelines implies that the CETV quantum is independent of the decision to opt (in the absence of a later decision not to accept a CETV) for either the PPF or BSPS2. This is at odds with what you were saying in October, Henry, about the transfer terms being different for each of the current scheme and the new scheme. I would assume, though, that the reported increase in the CETVs offered is the result of the capital injection into the new scheme to replace the sponsor backing. This would seem to support the idea that the CETV depended on opting for the new scheme. Logically, though, the most likely option in the absence of a decision to transfer is not the new scheme but the PPF, if (as is likely in many cases) maximising tax free cash was one of the attractions of considering the transfer option.

Taking your infographic at face value, including the apparent illogicalities it implies, this poses a problem for advisers, as the advice not only has to explain the different options and recommend a suitable choice but also to consider the tactics appropriate in the event the member chooses not to transfer, the 22nd deadline having then passed.

The other implication of the time lines is that an incentive to transfer is designed into the deadlines if the decision is not finalised until after the 22nd as the option selected may be worse then than transferring but the other option is closed. That ironically could lead people to favour transferring even if it stretches their expected ability to tolerate the volatility.

We’ve looked now at some transfer terms and, as we expected (per some earlier comments here), the uncertain future income distribution from drawdown, constrained to be sustainable in real terms to age 95, implies very little risk of shortfall, even with low risk tolerance. That longevity constraint is perhaps unfortunately a little high but is very conservative. These benefit comparisons ignore the chance that pre-97 benefits turn out to be capped which is much harder to model but cannot be ignored.

Our modelling assumes a portfolio managed dynamically to produce the planned cash flows within the constraints. The products are low-cost trackers and the management fees are designed to be sustainable in a largely digital world, not today’s still-to-be-disrupted 2-3% pa all-in. Of course, anyone who has transferred out but into expensive products has the option to adopt a different solution later. If they are some time off drawing benefits, they could easily adopt a low-cost solution for the assets and focus later on how to deal with the joint challenge of how much to spend and how too invest the fund once in draw.

Switching may expose people to exit fees but that is itself a matter of calculation. There is even a possibility the original transfer advice could be challenged with FOS and costs recovered.

These decisions can be taken more calmly without the pressure of deadlines.

The situation is this; at the end of March CETVs went up generally and especially for younger people as BSPS moved from equities to bonds and adopted a higher discount rate. Younger people did especially well as BSPS did away with a tiered discount rate which gave higher CETVs the older you got. Transfers went up again when the £500m cash injection arrived, the actuaries reducing the insufficiency deduction from 8 to 5%. All CETVs out now are guaranteed through to Jan 28th but after that they may well fall to reflect the option chosen (PPF or BSPS). All CETVs must be completed and with trustees by Feb 16 to be assured of being processed by March 28th, after March 28th the CETVs for BSPS are not valid, and new CETVs will be issued against rights in BSPS2, no new CETVs will be issued from the PPF but the PPF may honour the o/s CETV request but only to PPF benefit levels.

If I’ve implied something different in October, I apologise. I agree with your final point

Pingback: Contingent charging; remember Active Wealth? | The Vision of the Pension Playpen

Pingback: Concerns over the money invested though Active Wealth (UK) Ltd | AgeWage: Making your money work as hard as you do