Aegon has published it’s 2020-21 IGC report. In the past, I have been critical of Ian Pittaway’s reports but I sense a shift to a more responsive approach relying more on feedback from employers and consultants. This is reflected in the tone of the report which drew me into the IGC’s work.

The IGC is responsible measuring value for money for 1.95 million workplace customers across Aegon’s workplace pension schemes. Around 888,000 are in legacy products and around 1,064,000 customers in Platform Solutions, mostly on the ARC platform but also including 171,000 TargetPlan customers. The TargetPlan customers were formerly in BlackRock plans.

The bulk of the report concerns itself with explaining what is going on within Aegon on initiatives the FCA have directed the IGC to focus on

- investment pathways

- the integration of ESG into funds (especially the default funds)

It was difficult to make a meaningful assessment of what Aegon is up to with IGCs , but the IGC do not seem overly impressed by Aegon’s adoption of ESG.

There is further work required to apply ESG fully across the funds available to you.

I note the future plans for the IGC to monitor investment pathways, but there is no plan to monitor footfall. A major test of investment pathways is whether they are used and if they aren’t “Isio” will be a busted flush.

Coping with the pandemic

The longest section of the report focuses on Aegon’s response to the pandemic. Aegon was one of two major insurers (the other was L&G) that closed its call centers in the early weeks of the pandemic, leaving customers to find out what was going on as markets dived without a voice to speak to.

This strikes me as a major failing and I brought it up when commenting on the IGC’s 2019-20 report. 17 months have passed since Covid hit Aegon’s Edinburgh HQ in mid March and clearly things have recovered.

50 is considered excellent

But the failure of the disaster recovery plan to respond to a disaster is noted in the report and it’s heartening to read that the IGC are pressing for improvements in call center performance.

Value for Money

I mentioned earlier a change of tone in this year’s report. It has become more outward looking and receptive to external views. It is critical of Aegon’s efforts to talk with members and has reduced Aegon’s communication rating from green to amber

In future, we will challenge Aegon to provide more evidence that its communications are having a measurable impact on member outcomes and our value for money rating will take that into account.

It is also talking to the employers who fund the workplace plans on whom Aegon’s proposition depends

During the year the Department for Work and Pensions (DWP) carried out a survey of workplace pension charges. All the main providers of workplace pensions took part in this survey and it was helpful for the IGC to get an indication of where Aegon ranks relative to others. The DWP report looked at how the average charge varies depending on the number of members in the scheme.

The chart that follows is one of the most important disclosures I have read in an IGC report and I hope it finds its way onto the agenda of every workplace governance committee with an Aegon scheme.

I am genuinely impressed by this disclosure and hope that what is happening with the benchmarking of costs and charges will extend in future years to an analysis of performance and how it is impacting member outcomes.

This is still an area of weaknesses for IGCs and the reporting on performance of the principal funds within the report is weak – telling us little about the value these funds are bringing to members.

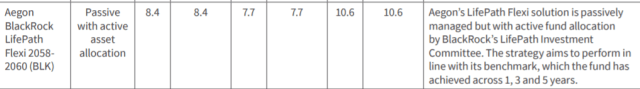

First, let’s look at what is going on within the principal funds on the ARC platform

The two funds have the same benchmark but are producing quite different results. There is no explanation as to the 5% outperformance of one fund over another over the past year.

The reporting of the Lifepath Flexi solution is against a benchmark which exactly matches the performance of the fund, again there is little explanation as to what is happening within the fund despite the radically different returns it is delivering to the two ARC funds.

It is time for this IGC to ask serious questions about these three funds and work out which is delivering best outcomes – including best outcomes for society and the environment.

Let’s hope that when the FCA and TPR finally deliver their end of consultation response on value for money, they will provide some practical guidance on performance comparators. At present we seem stuck in a loop that assumes all funds perform the same way and all that differentiates VFM is the cost of the product to members.

Conclusions

I like this report much more than some precious ones. It has a refreshingly candid style and talks to employers and members as their representatives. It gets a green for tone.

I also find the IGC has been effective in providing good information for members and employers on charges and really getting to grips with service levels during the pandemic. It is clear that they are getting tough on Aegon on member engagement and ESG. The report gets a green here too.

The report is more member centric but its value for money analysis has still to properly address whether Aegon’s claims for its funds are feeding through into good outcomes. I have suggested to the IGC that more can be done here. The section of reporting on performance and funds in general is weak and marks the VFM assessment down to orange.

Aegon, uniquely, provide a video from its members. I think that more could be done with the video (which isn’t exactly Tic-Toc) but at least it gets you a feeling for where the independent members are coming from. I am intrigued as to the photo of the horse on Ian Pittaway’s bookshelf, a prize to any reader (including Ian) who can name the nag.

Pingback: Standard Life’s IGC’s filibuster | AgeWage: Making your money work as hard as you do