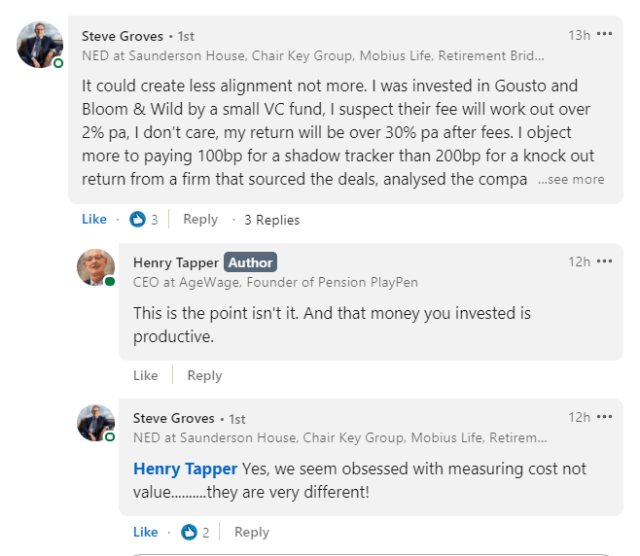

I don’t often agree with my friend Steven Groves (at least not on social media) but we found common ground yesterday after I argued that the charge cap needs a carve out to accommodate performance fees when something goes really right!

It’s easy to forget in austere times for real yield that new companies spring up like islands from the sea and become fertile and create value for their founders and followers.

That Steve has got a return of 30% after fees , doesn’t make the fact that would have been 32% before fees go away, it just says that the 2% in fees represented value for Steve’s money.

I am currently going through the arduous process of raising money for AgeWage. I know what goes on in the selection process and it’s really tough both to get investment and for the investors to sort out the wheat from the chaff. The money changing hands is small change to the likes of Mark Fawcett and Nico Aspinall (the CIOs of Nest and People’s Pension) but it is the money that kick-started Monzo , Revolut and Pension Bee.

Nobody begrudges Romi Savova her millions nor her backers their returns nor should they. But if Pension Bee had formed part of a venture capital fund into which Mark or Nico had allocated their member’s savings, that fund might be asking questions of the cap, especially if the performance fees for the crystallization of Pension Bee’s £370m valuation all came in this year.

The cost of loss

Of course for every Pension Bee, there are twenty of less distinguished failures. Mark and Nico’s fantasy fund can show 100% of its value at risk and expect to see a high proportion of the investments fold. This is not ponzi-land, it is the attrition you expect with start ups and if you can’t countenance failure then you are not a realistic entrepreneur. For me, knowing what failure looks like drives me to succeed, but I know I can afford the cost of loss because I am not betting my life.

This life-lesson keeps a smile on my face when AgeWage gets setbacks, as we do as often as we get wins. The job of the entrepreneur is to treat each imposter with the same indifference and set the eye on the bigger prize.

Unicorns

It is often said that if you are not running your business with an eye to be a unicorn, then you don’t deserve investment. For those who don’t deal with unicorns, “Unicorn” is a term used in the venture capital industry to describe a privately held startup company with a value of over $1 billion.

To have that kind of valuation you need to be in a market where there is potential for vast revenue, running a sweet shop in Tooting is not a recipe to make you a unicorn, owning Mars is more like it.

Venture Capital is driven by entrepreneurs convincing thick-skinned investors they are serious about making their companies unicorns, daring to dream the impossible dream, doing a Romi.

Which is why I am pleased that unicorns are recognised in the charge cap carve out. If I find out that Mark and Nico are investing in AgeWage I will be delighted, even if a proportion of the return they get goes to a venture capital fund manager. If that fund manager draws down performance fees representing 5 or 10% of Nest or People’s investment in return for delivering up AgeWage as a fully listed company worth £370m, then I am sure I will be toasted and boasted , not berated for creating an accounting problem.

I would similarly expect Nico and Mark to be acclaimed for their foresight in investing in AgeWage at its current valuation!

Dare to dream

I dream of changing pensions for the better, giving millions of savers access to information on their pensions that helps them take sensible decisions over contributions , pot aggregation and investment pathways.

If my dream turns to reality I will be rich and so will my shareholders and I hope that my shareholders will include Nico and Mark. I hope that I will cause accountants problems accommodating the fees for my success in their charge cap and I am grateful for the Treasury and the DWP for making sure that my dream s are included in the investable universe.

Pingback: What’s the Long Term Asset Fund and will it work? | AgeWage: Making your money work as hard as you do