We don’t always see eye to eye!

There is a strongly held belief by those on the right wing of the pension debate, that people aspire to be self-sufficient in retirement of means tested benefits. Frank Field was a great exponent of this, arguing that means testing is degrading and divisive. Ros Altmann is another. She has written a comment on my blog yesterday which I want to explore. Here it is.

I feel I need to comment here Henry, because on this one I have serious concerns about your approach and your criticisms of the Pensions Regulator. Do you know how many of those who have money in pensions now

a) have no savings,

b) have maxed out credit cards

c) have no access to other help or support to tide them over a difficult period

d) can’t afford heating or food AND

e) are over age 55?I believe it will be a small subset of those people that you and I are really concerned about, those who have nowhere else to turn and face penury in hunger and cold. If they are over 55, and have pensions, they might still be better off with other types of help for the moment.

Pensions are precious – they have huge advantages that are designed to help people over a lifetime and tax relief is not given to fund people in their 50s and 60s – pensions are needed for much later life too. It does worry me that people are too focussed on taking money out when still relatively young. Of course a few people can benefit by using their pensions and paying 20% tax on their withdrawals (ok more like15% after TFC) but the vast majority should not be looking to touch their pensions if they have other ways of supporting themselves through this crisis.

The Pensions Regulator is right, in my view, to point this out and I would be really nervous about any public programme or pressure that urges people to spend their pensions, rather than keep them if they possibly can. Even those who are out of work may be back in work in future and might be auto-enrolled in future, but once the many years of pension contributions plus tax relief (and some employer contributions) are lost, they are gone. They are long-term spending money and those who are under 55 cannot access their pensions anyway, so whatever is put in place to help them can apply to older people too, rather than draining pensions unless absolutely vital.

In answer to Ros’ questions, I don’t know how many of the population will find themselves so hard up that they can’t meet food and heating bills this year or next, but recent work by the Institute of Fiscal Studies suggests that absolute poverty is a particular problem for people in the years approaching their state pension age

The IFS link this directly to the poor level of jobseeker allowance under Universal Credit, relative to the state pension and pension credit which become available at state pension age (variously 65,66 and 67 over the past few years).

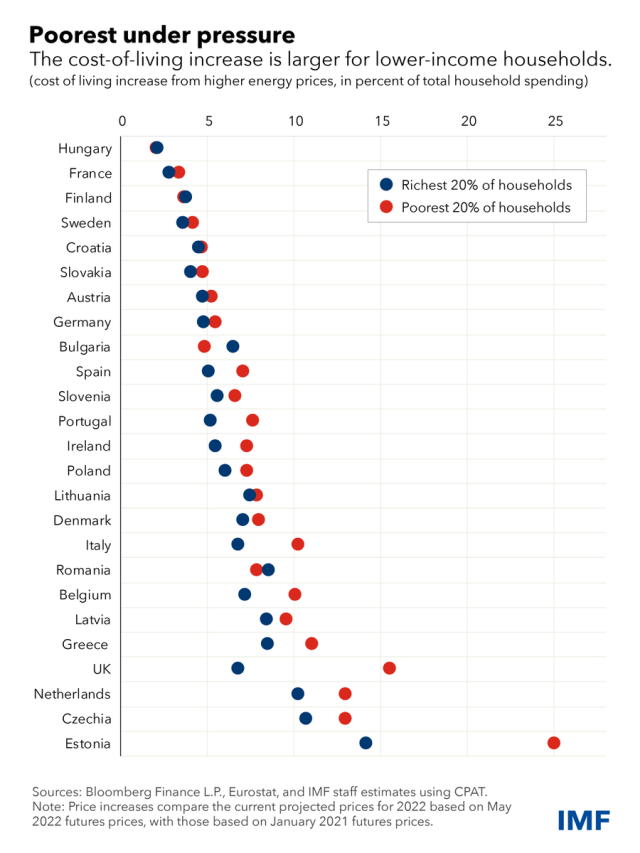

What we can be sure of is that absolute household poverty will increase as inflation kicks in because fuel and food inflation is going to hit poorer households hardest

We also know that the lowest earners find it hardest to save for many reasons, the main one being they don’t have net disposable income to put into a pension pot. So they are impelled to save by auto-enrolment, typically at very low levels, because of the lower earnings limit. And the saving is often inefficient- because of the net pay anomaly. This leads to people having small pension pots about which they get very little advice or direction (despite noble efforts to set up and run Money Helper and Pension Wise).

I recently gave a talk to senior people in the pensions industry about the plight of people with small pots who were never going to be self-sufficient. I pointed out that the small pots were likely to prevent many people with limited state pension entitlements from claiming pension credit because of the deemed income rule, that rates pension saving as pension income , whether it is drawn or not. In the past people got “savings credits” for limited savings, now those savings don’t help them qualify for pension credit, they can debar them from it.

And it’s even worse than that, because most people could cash in small pots prior to retirement without that money preventing them getting universal credit (encasements falling within the capital allowances but not deemed as income). So it’s absolutely in the interests of people close to poverty in their sixties to use their pension savings to meet their household bills.

But there are other arguments too and much more powerful ones. Firstly, the absolute poverty that drives people to food banks and causes them to get cut off from their electricity and gas suppliers (with resulting CCJs) is not a result of fecklessness, too often it is a result of people who have savings (in pensions), believing that this money cannot be taken to pay household bills.

An example of this is the pressure brought by the Pensions Regulator on pensions administrators to consider people taking money out of their pots to pay household bills as a type of “scamming”.

TPR is warning that savers may be lured by offers to access their pension savings early to cover essential household bills

I wrote to the PLSA yesterday, urging them to consider running a cost of living session at its upcoming conference. To her great credit PLSA chair Emma Douglas engaged. She wrote to a group of us that claims on pension pots have increased 32% this year with partial claims increasing 38%. Far from being appalled, Emma was pragmatic

Clearly accessing it now means it won’t be there to spend in later life, but immediate needs are pressing, and will be more so come the autumn.

Pension pots are for spending. The ideology of self-sufficiency is set against that of double -dipping (where people spend their way into destitution to get a better bit of state benefits). But the people who have small pots, big bills and no spare cash are not double-dipping, they are in need of money now to avoid the horror of financial destitution.

Is it irresponsible of me to argue that those with small pots and low income in their sixties would be better off using their pots as abridging pension? I don’t think it is. When I think of the ruses I have seen over the years to maximise tax-breaks for the wealthy, encouraging people to bridge to 67 using pension savings does not seem irresponsible, it is restoring some kind of balance to a debate where 90% of the pension support goes to the 10% of people who need it least.

We will not rid this country of pensioner poverty until we have the kind of productivity that ensures a universal system of benefits that ensures everyone is lifted out of poverty as a right. Targeting benefits to those who really need them is, for now, the best way of making sure the needy are targeted with the most help.

Ros’ view of a world where our pensions makes us self-sufficient is ideological not practical. In practice, needy people need to make the most of the little they’ve got – to maximise the little help they get from the rest of us.

I can see the pros and cons of both your and Ros’ arguments. But Poverty in the UK exists because of the supremacy of those who believe that people are poor because its their fault. The use of small pots won’t do anything more than apply a sticking plaster to.a gaping wound. Whilst we still peddle the belief that those who are poor bring it on themselves and those who are super wealthy deserve to be so much better off and to keep their wealth whilst others cannot eat properly,or keep warm and clothe themselves and their children, then people in poverty have no hope. Cashing in small pots is a side show. The big picture is that until wealthier people willingly help poor people then our society will continue to degrade. The way that should be done is not by charity but by fiscal policy. The UK is still one of the wealthiest countries in the world and yet the disparity in how that wealth is distributed means millions are now living from hand to mouth.

Henty. The hole point of this argument is that we as a society should be more generous to ‘those of our own’. It is very laudable with those ‘of property and comfortable’ should offer ‘charity to Ukraine etc” but do they, the government or the employers see a similar needs of those of us, or ‘want to address’, similar problems ‘in our own country’. Anyone of us who are forced to find ’employment’ are ‘at risk’ their whole lives and cannot rely on firm employment probably beyond their 50’s. Many employers have or had an active policy to ‘weed their older employee’s’ to save money on pension contributions, National Insurance etc So if these were anyway on lower income they would face ‘unnecessary poverty’ until their NRD kicks in. The only income they may have would be that 80.00 GBP per week – that gets one nowhere these days. Its all very well for you professionals to be pontifical but its you that are not facing reality!