A troop of CEOs have paraded accross New Model Adviser in the past week, all claiming that banning contingent charging would stop advisers working in the mass market.

Quilter’s Andy Thompson speaks out here

Simply Biz’ Matt Timmins speaks out here

SJP’s Andrew Croft speaks out here

More from Quilter and Royal London here

Meanwhile Prudential research suggests that half of financial advisers report that they would do less DB transfer business if contingent charging was banned.

Considering the FCA’s contention that around half of the advice given on DB transfers is flawed and that a high proportion of the recommendations to transfer should not have happened, the FCA must feel satisfied that their proposals are on the money.

Who benefits from transfers?

While the CEOs have been speaking to IFAs via the trade press, explaining how supportive they are of IFAs spreading the transfer love, they have also been speaking to analysts about the drop in new business from the slowdown in CETV transfers they’ve been receiving this year. It is – it seems – something that was not expected to happen.

As we all know, the reason the flow of CETVs is slowing is because professional indemnity insurers are restricting the numbers of CETVs , forcing IFAs to ration advice. Did the retail divisions of these providers ever think the levels of CETVs they received sustainable?

The ban on contingent charging will simply restrict the numbers of CETVs recommended, it would have little to no impact on the broadening of ongoing financial planning. The vast majority of CETV money is now with insurers or in DFMs and generating ongoing fees which benefit insurers, DFMs and financial advisers but were never designed for the mass market clients that SJP, Royal London, Quilter and SimplyBiz believe would be excluded.

The FCA and workplace pension schemes (WPS)

In a bizarre twist of logic, one independent adviser is now accusing workplace pension schemes from excluding them using them.

If workplace schemes were forced to have to pay adviser fees, I wonder how many workplace schemes would become suitable and clients would get better outcomes?

— Nathan Fryer 👨💻 (@fryer_nathan) August 16, 2019

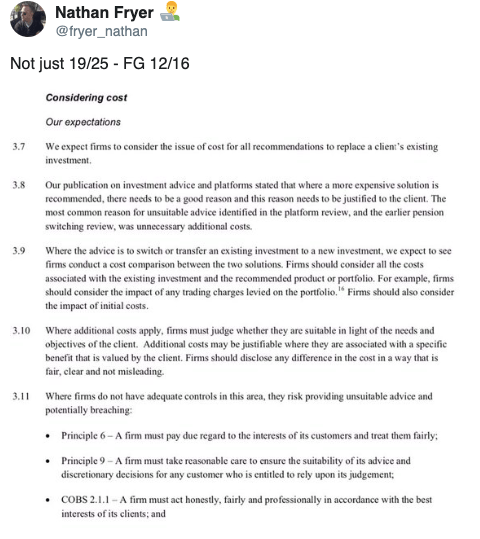

From the conversation I am reading, the problem is around the FCA’s insistence that these cheaper products are considered in IFA’s recommendations and that IFAs will have to explain why they have not chosen what on the face of it look cheaper solutions to the ongoing management of money. This is reckoned an irrelevance by another IFA

This is a point in 19/25 which is getting disproportionate coverage I haven’t had any cases we we recommended transfer where the person was a member of a WPS/ or had one that could take a TV.

Mind you they were all 55+— rob reid (@reidremoney) August 16, 2019

Where exactly the customer stands in all this is unclear,

Workplace schemes are hidden

Another adviser rightly points out that at the time of BSPS’ Time to Choose, steelworkers – who by and large were in WPS were not offered them.

With BSPS, I remember was that both Aviva (Port Talbot) and L&G (Scunny) offered both initial charges and ongoing charges to an advisor. They explained very clear they are not bound by AE regulations to cap cost on transfers in, just on the AE fund.

— Eugen Neagu (@BespokeFS) August 17, 2019

He is right. I wrote about this at the time and you can see from what I wrote then that it wasn’t just the IFAs who were avoiding WPS, the insurers and the employers were scared silly of their products being used too! Please read the article below.

Has Tata the courage of its conviction? (the workplace pension that dare not speak its name)

At the time – Michelle Cracknell called out the scandal of the unused Tata and GreyBull workplace pensions. It has taken nearly two years for the FCA to swing round its guns but now it has.

The questions that need to be answered by these CEOs

- Why did you take CETVs onto your platforms without question?

- Why did you not promote WPS alternatives – when you had them?

- Are you reviewing the suitability of your products recommended?

- Will you consider restricting charges on those products to WPS default levels?

If you cannot answer these questions, then I wonder whether your commitment to mass-market advice is anything more than a sham. Contingent charging looks like backdoor commission and your arguments for “broader advice” sound like volume and margin preservation to me.

Margins and volumes preserved by vulnerable customers who should not be in your products.

I am unconvinced that in a low return environment where the yield on an annuity is around 2.5% nominal, charges of 2.0% pa + on drawdown (let alone accumulation) can ever be in the client’s best interest. But what I see reported to me by those who have transferred and the IFAs and solicitors who are trying to sort out the problems of 2016-18 is that such charges are common.

It would be better if – instead of arguing for more of the same – insurers, SIPP managers and IFA compliance services faced up to the reality of the situation which is that billions of pounds is in the wrong kind of policies, in the wrong kind of funds with the wrong kind of fees.

Legal & General provided me with me with a transfer illustration but stated they could not facilitate a transfer. They have also just confirmed that they could only pay the transfer fee from the fund, but not the ongoing annual advice charges.

Spot on. It seems there is a large secondary market now where client and advisers are looking for Value for Money solutions. Especially now they have received disclosure documents in £. The good news is that there are now excellent solutions that can improve on WPS cost terms with multi asset funds costing 10 bps.

There is always going to be a secondary market. Financial planners are competitive, and have developed slightly different propositions!

The problem like always is how clients could make the difference!

Henry, for as long as gilt yields are very low (10 years gilt yield is now 0.46% per annum) and there will be companies with weak covenants out there, pension transfer specialists will be busy.

With regard to paying for advice, clients will pay from their own pockets a fee that we expect to be close to £5,000. And the ones they do not have that amount, IFA may give them loans with 0% for 12 months (there is no need for credit license for that).

Let’s say that the recommendation is not to transfer, the client will go home with a £4,500 loan for the next 11 months. Probably he will transfer to pay the financial adviser on insistent basis or do it yourself, to get rid of the loan. Personally, I do not think loans are great, but it is for prospects to decide if they take them or not.

The majority of prospects will be over age 55 and very few will fit the WPS conditions, as described in the consultation. Some will need to take benefits immediately after transferring, to pay for the loan they took to pay for the advice!

Banning initial (contingent) adviser charges would change advisors fee structure for ever, more and more will become ‘wealth managers’, charging nothing initially for all clients, and charging more (even more than 1% per annum) ongoing.

You say charges of 2% per annum, would not be in the best interest. However in the end what counts is the net performance after charges. I have researched WPSs default schemes, quite a few apart from Scottish Widows, Nest, and Aviva has improved more recently, do not perform that great.

There is a clear benefit for clients hiring financial advisers. They end up making better decisions, and as a result they accumulate more wealth.

Just today Aviva sent me another letter, after they sent me a few days ago my annual statement. There are some changes which I am still trying to figure out, the letter is so poor drafted that for many it would not be intelligible at best.

There’s a lot in there that is sensible Eugen, but let me pick up one or two points.

The reason that DB some schemes quote higher CETVS than others is because they are super-low-risk – investing mostly in matching rather than growth assets. So these schemes offer a good security. The schemes that offer less good security are those that invest in growth assets and these schemes tend to be the ones that want to pay the pensions themselves. These open schemes may have some very strong sponsors who just want to run pensions for ever.

In other words, there are some strong employer covenants paying low transfers and vice versa – the picture can be complex.

CETVs for schemes with high security can be 30-40 times the prospective pension, yet I still read reports talking of these schemes offering questionable security. In other words, I do not think that proper analysis is being made of the transfer value itself and of the security of the scheme and – as importantly – the covenant of the sponsor.

Finally , the risk of scheme failure for someone with a small benefit is less than for a big benefit (the way the PPF works). This is seldom mentioned in reports which I find to be generally written from the standpoint of the high earner.