LCP and Royal London jointly presented to an audience of 300 industry professionals yesterday on the vexed topic of “helping members get transfer advice”.

LCP and Royal London jointly presented to an audience of 300 industry professionals yesterday on the vexed topic of “helping members get transfer advice”.

The webinar can be watched here and as you’d expect from these organisations, this was a thought provoking and responsible event that looked at the issues facing members, trustees, employers , advisers and personal pension providers in depth and through meaningful research. I found it gripping and it got me thinking

While I fully understand the positions LCP and Royal London are taking, I think they are the wrong positions and this blog explains why I take issue with their arguments

Why are people taking transfers?

The right to take a cash equivalent transfer from a defined benefit pension scheme into a personal pension has been in place since July 1988, that’s 32 years now

However the analysis of changing regulatory attitudes, conducted by Steve Webb started in 2015

It is easy , but wrong, to consider pension transfers a product of pension freedoms. There is no evidence that the pension freedoms were what drove 170,000 people to transfer £80 bn out of defined benefit schemes between April 2015 and September 2018.

All the evidence suggests that people did so chiefly because of the increase in transfer values as schemes de-risked , discount rates fell and average transfer values rose from around £200,000 in 2012 to over £500,000 today. These increases were not down to pensions increasing in the period, most DB schemes were closed to future accrual.

As people realized they had accidentally become wealthy because of their pension schemes, wealth managers found ways to facilitate the taking of CETVs in a painless way. Rather than pay up front for advice, those who had wealth in their pensions but little in their bank account could unlock their DB pension where the adviser charged out of the proceeds of the transfer.

What happened in these three years was an explosion of activity among financial advisers who took advantage of contingent charging, high transfer values and the appetite of the public to get to their accidental wealth. Having spent time with many of those transferring, the mechanics of pension freedoms were of minimal importance.

Linking DB transfers to pension freedoms is a way of creating a populist argument for pension transfers, but it is a flawed argument and has insidious intent.

Why is transfer activity now reducing?

The FCA were growing nervous about the quality of advice because the new wealthy, particularly the 7000 steelworkers who transferred out during BSPS’ time to choose, did not generally show much understanding of what was going on with their pension rights or have much idea where their money was going.

The FCA’s findings finally led to the banning of contingent charging. Steve Webb was right to point out that for the majority of IFAs , there is no question of consumer detriment in their offering advice.

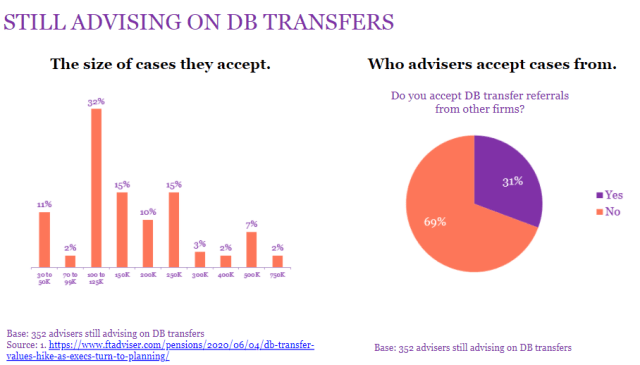

Many IFAs remain in the DB transfer market and those who have given up would like to return if they could afford the PI premiums and if the FCA made life a bit easier

This is not surprising, the £80bn that left DB schemes between 2015 and 2018 continues to provide IFAs with considerable revenues and IFAs do not want the tap to be turned off because the recurring revenues from those transfers are what give their businesses value,

The importance of recurring revenues to IFAs cannot be underestimated. That huge amount of money is not sitting in workplace pensions but in much more expensive wealth management accounts , much of which is managed by the IFA with layered advisory and discretionary fund management fees

The FCA are now asking IFAs to justify the increased costs of their products against workplace pensions as a benchmark

Royal London’s research into the future of DB transfers was carried out prior to the FCA confirming it was banning contingent charging. The challenges facing the advice on transfers have increased since this research was carried out (as has the rate of withdrawals by advisory firms from the transfer market).

The concern for Royal London is that financial advisers ,having adapted their business models to meet the demand to convert pensions to wealth, are now finding their transfer permissions withdrawn or unaffordable. Royal London and other insurers are of course major recipients of CETVs into their SIPP products so there is little for them to like about the challenges IFAs face. But this does not support the argument for the FCA to step in and

LCP is also concerned that the tap is being turned off. Here the concern is for the trustees and employers of occupational pension schemes who are concerned that their schemes are no longer to be de-risked of liabilities because of transfers.

While I have no issue with the analysis of why DB transfer advice is harder to find, I do not agree with Royal London that the FCA should be supporting the market in DB transfer advice, it has – through the tax-advantaged contingent charging loophole, done that for too long already.

The pension freedoms are not dependent on DB transfers and more than the other way round, the public interest and consumer interest is best served by the majority of people taking their pensions from occupational pension schemes.

Should pension schemes encourage transfers?

Steve Webb took as his starting point for arguing for greater intervention by employers and trustees, the Rookes report into the debacle of the BSPS time to choose.

Rookes argued that trustees should argue what “good looks like”, but with regulatory pressure from tPR being so strongly in the direction of de-risking, good increasingly looks like getting rid of liabilities – primarily through transferring them to insurers and back to members

LCP point to a growing trend of schemes not to incentivise transfer values (they are quite high enough as it is ) but to facilitate advice from the diminishing pool of advisers.

LCP and Royal London have issued a joint report on how this might best be done and it can be accessed here.

Having contributed to the Rookes report and had several meeting with Caroline Rookes, I do not think she intended for her findings to be interpreted as an endorsement of trustees encouraging transfers. The Trustees of BSPS were shocked by the number of transfers taken and the Chairman told me he hoped trustees would in future be given more powers to support their scheme as a payer of pensions.

As with his analysis of the link between pension freedoms and transfers, I suspect that Steve Webb is over stretching a point and playing to his audience.

I am queasy about this

When Steve Webb stood up in front of the NAPF in 2015 and waived bundles of notes at trustees and employers who were incentivising transfers with what he called “sexy-cash”, I applauded him. Pension schemes are for paying pensions and shouldn’t be using gimmicks like cash incentives any more than advisers should be factory gating offering sausage suppers.

The idea that people are taking transfers to exercise their rights to pension freedoms is – in my opinion – plain wrong. People are taking high transfer values because they think their advisers can do better for them with their wealth management than the trustees can do. While I accept there are risks, especially for those with big pension entitlements from a failing sponsor, I see the PPF as a pretty strong safety boat and the risks of a wealth manager failing are not covered by the PPF but by a less robust lifeboat in the FSCS.

The idea that trustees – because of the Rookes review – have some kind of obligation to provide or even subsidize transfer advice is also – plain wrong.

As schemes move towards self-sufficiency, the prudence with funding strategies will increase , discount rates fall further and transfer values increase. We risk a dystopian world where members are tempted into transferring by a system that has no regards to the long-term cashflow implications of paying these ruinously high values.

It is much better that trustees step away from facilitating DB transfers than risk involving themselves in an increasingly litigious area.

For once , I don’t agree with LCP’s calling for employers to promote DB transfer advice. Nor do I support Royal London when they call for the FCA to create a new market for ongoing transfer advice.

The days of friction-less transfers are going , we are in the final days of contingent charging and PI premiums reflect the regulatory climate which is now adamantly against the mass promotion of DB transfer advice.

There is good reason for the change in the Regulator’s sentiments.

Whilst I appreciate your sentiments, Henry, I have to say that there are circumstances where transfers can be the ‘best advice’. Indeed the last (small) case I recommended go ahead was from the Clark’s (shoes) Scheme after an appalling diagnosis for the member who has now died.

Are we not in danger of barring those who can benefit from a DB transfer from any advice source?

Henry, I agree with your comments above, in particular Trustees should not become involved in giving “advice/guidance” – it is a slippery slope.

However the source of the “problem” on transfers is driven by excessively large TV’s based on market rigged gilt yields,which in turn are being pushed by LDI strategies and TPR. The market rigging is backed by BoE using quantative easing and Government’s interest in keeping interest rates very low or negative.

Trustee already have the ability to decide their assumptions to be used to calculate cash equivalent transfers. Assumptions do not need to be linked to gilt yields. However it is my belief the majority of trustees merely accept their Scheme Actuary’s recommendations. So when linked to scheme de-risking, Employers can be indirectly complicit in allowing excessive TVs to be offered.

IFA’s should be encouraged to provide impartial independent advice, and I believe the majority do. You can’t single out IFA’s for taking advantage of pricing bubbles driven by market distortions. For now it is Employers with DB schemes who are paying to high a price, and it is likely their former employees in their later years may come to regret their decisions. The only winners will be the Wealth management companies taking a “recurring management fee” on their clients assets. .

Henry, what is interesting is that people have already found solutions to the new regulatory changes. I think the new rules makes it even easier for many pension transfer specialists to operate.

PI insurance premiums are based on turnover, so the job was broken in two: one firm does the pension transfer advice and charges £x for triage/abridged advice and £Y for pension transfer advice. That £Y is taken from the fund when the transfer is recommended, as it is more tax efficient! Pension transfer specialists turnovers tend to be smaller, as they do not have any ongoing charges for looking after these clients. These ongoing clients are charged by the firms which introduce these clients to the pension transfer specialists, and who only need to prove they charge the same for these clients as for their other clients! (Pretty normal I would say!)

Only cases where the pension transfer specialist believes there is a transfer are progressed to full advice, the others are told at abridged advice it is not likely a transfer, and recommend not to transfer.

The pension transfer advice is still paid more or less contingently, from the transfer. In the unlikely case that some clients take it to full advice and results in no transfer, the pension transfer specialist would need to show they are chasing bad debts. The poor guy would need to pay for the advice from his pocket, or be made bankrupt etc

Pingback: Balance sheet relief leads to later life grief? | AgeWage: Making your money work as hard as you do

Pingback: Weathering the Storm | AgeWage: Making your money work as hard as you do