Ever the optimist, I kick off with an image of a pot that has been broken and becomes a thing of beauty. For many of us DC pension pot holders, this is devoutly to be hoped for.

Though for some, the events of the past 9 months will make us feel our pension plans look a bit like this.

A different story for young and old

For the young!

I am old enough to have lived through a number of bad years but have benefited from starting to save for my retirement in 1980 when I was still at college, here are some numbers that show how investing in the stock market has provided real growth on our savings since 1972.

Along the way , there have been some bad years, here is a breakdown of the yearly results since 1972;

- Returns of 20% or more: 19 years

- Returns between 10% and 20%: 13 years

- Returns between 0% and 10%: nine years

- Losses between 0% and 10%: four years

- Losses between 10% and 20%: two years

- Losses of more than 20%: three years

2022 could be one of those rare years where markets fall more than 20%. The world’s biggest market is heading in that direction

But if you are invested in a typical pension fund and you are young , you should not be disconcerted.

- You are currently buying units at a discount, when they bounce back, these cheap units will be your star players, so long as you are saving regularly, you get the benefit of buying in the dips (and you aren’t a seller yet!)

- You are probably invested in more than one market, some stock markets have done better than others, the UK stock market has been resilient, partly because its a sin index dominated by energy and tobacco companies.

- If you are lucky, you are getting the benefit of a cheap pound and the investments you are making abroad are bringing you supercharged returns because they are made in overseas currency.

So

Since you are almost certainly in no control of where your money is invested, how it’s invested and whether your investments have currency hedges, what you are getting on your pension money is a lottery!

If you are young , the best you can do is nothing but save. You may want to vote with your feet and exercise your convictions (invest in tech rather than fossil fuels or avoid income stocks by investing in a Halal way). Those strategies paid off in recent years but not this year. But you are probably in a default fund with no idea how your money is doing.

So let’s lift the lid off a typical default fund investing your money if you are 16- 50 years old. This happens to be the Fidelity Global Equity Fund and surprisingly , it is showing that you would have been making money on your investments over the past year.

This is because this fund is diversified across a number of stock markets (not all of which have done as badly as America, because it has picked up returns from the drop in the pound (it’s unhedged) and because the last few months of 2022 were good news all round.

Though many default funds, including Fidelity (who’s numbers I’m using), invest some of your money in funds that invest not just in shares but in other assets like bonds and property

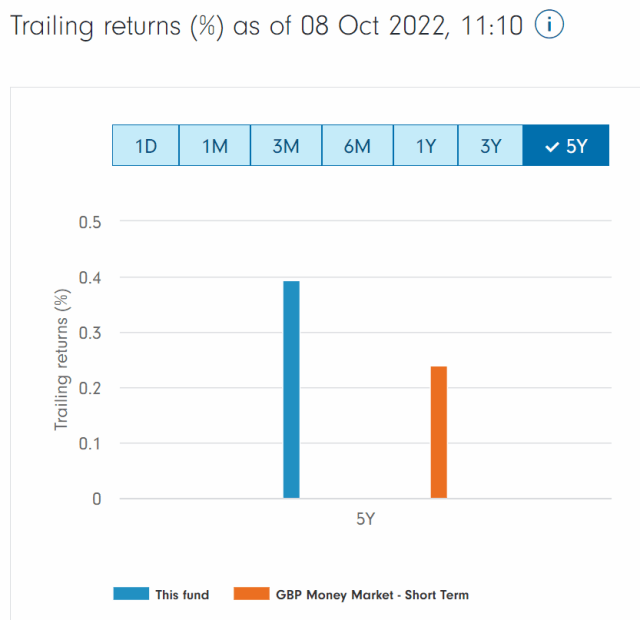

These diversified growth funds have not done so well over the past 12 months. Here’s that Fidelity Diversified Markets Fund.

Diversifcation has not worked for many of the big pension players. Standard Life tried it with their GARS fund, which has been a bit of a disaster, Legal and General use a Multi Asset Fund that hasn’t done well. The workplace pensions that have done best for youngsters – have stuck with simple strategies that invest in global stockmarkets.

The news for youngsters is that you are ok, stay with your defaults which are getting you into world markets and (unless you are unlucky and have been hedged) getting you some lucky gains from currency. The more “diversifcation” in your funds over the last year, the less well you’ve done – but heh – there’s plenty of time to make up loss ground.

For the old

For older folk , the past year has not been such good news.

If like me, you are an older worker , you may not be so lucky. You are likely to be invested in what are called “low-risk” funds. Such funds are typically investing in bonds. This is how Fidelity’s Aggregate Global Bond Fund has done in the past twelve months, relative to previous years.

that’s not such good news , but at least you will be getting some relief from a better return on cash, where your savings will also be “invested”.

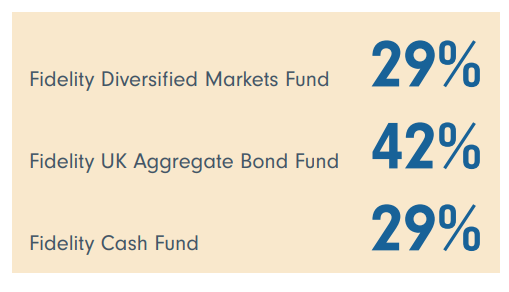

The average save with Fidelity would have – by my age – a split between these funds like this

Sadly , you are also invested in that Diversified Market Fund which is supposed to protect you against stock market falls, but hasn’t really.

So if you are old and in a workplace pension , you are in bad shape, because you are typically being invested in bonds, diversified funds and cash, rather than equities.

A topsy-turvy world

So why are old people invested in funds that are considered low risk but have lost them money (even cash hasn’t come close to matching inflation at 10%), while youngsters have been in higher risk funds which have actually provided positive returns?

The answer is that most people are paying for insurance that they don’t need and the cost of that insurance is paid for out of their pot. Indeed the cost of investing in bonds and cash over the past 12 months may have put a crack in your pot.

Unless you are planning to cash out your pension to your bank or to buy an annuity, there’s not much point in being in anything but growth assets – shares, property and the like.

But in the topsy-turvy world of workplace pensions group-think, the idea is that we “oldies” – (e.g. over 50) need to avoid world stock markets.

We have some explaining to do!

A typical de-risked default fund will have returned minus 20% this calendar year, a typical fund for a youngster – loaded with risk – will have just about broken even. That doesn’t make sense.

The pension industry is going to have to explain to older people why their de-risking plans have gone so wrong (unless they didn’t adopt the kind of approach outline above).

Youngsters may well ask if they are likely to find their pots broken in similar ways in years to come and they too will be asking the right question.

The problem most DC pension providers have as we come to the end of this turbulent year is in explaining how de-risking has done so much damage. This is a rather similar conversation to that between LDI managers and DB pension trustees.

The question those who have been de risked should be asking is “can my provider make something worthwhile out of my broken pot”. That is tomorrow’s challenge!

Henry, the game has become a mot harder.

The momentum trade i.e. investing in passive funds, has gone. Security analysis is back in town, taking advantage most people are passive these days.

Im the same time, we all need to understand that we cannot fight gravity i.e. the increase in the discount rate. We need to embrace that.

Yes but the same gravity means that the risk-free rate has risen significantly (unless you believe that the government is no longer good for its obligations in which case the whole is up (Ed)). Therefore strategic portfolio construction strategies are back and we’re not just pursuing absolute returns with no safety net. So there are benefits.

If you look at your best investment over the last 50 years it is probably your house and because it was leveraged, sometimes with a tax subsidy and/or exemption and politically supported the IRR is exceptional. There should be a property component in the investment mix as well as jurisdiction considerations.

Future performance is unlikely to be as good and “my house is my pension” may well end if downsizing is not done soon.

Stock market returns and survival of companies is damaged by remuneration incentive especially debt financed share buy backs.

Measure what matters, it is the income produced and far too many archive in excess of a living wage

Far too few