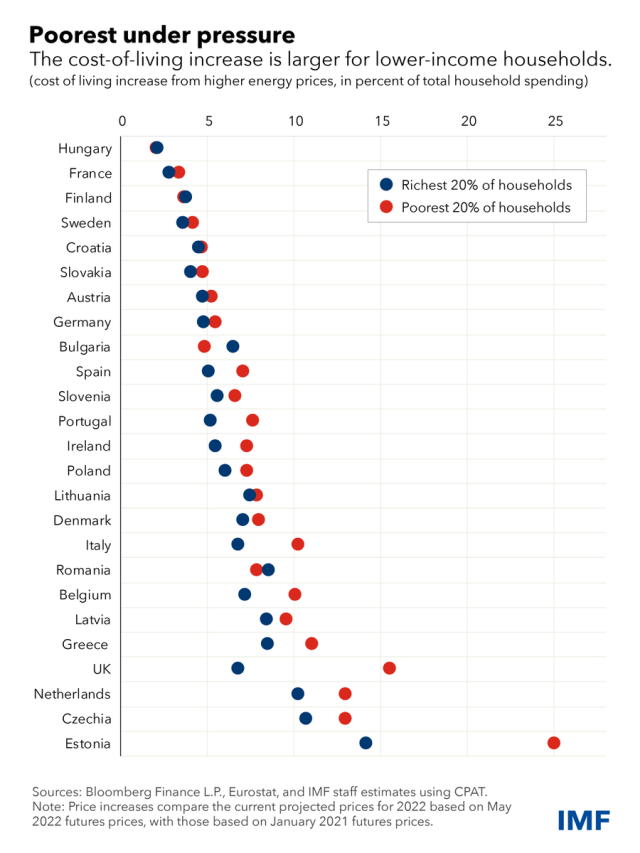

This IMF chart is (rightly) getting a lot of attention given the UK figures are truly awful. But why are they so bad? Because this is what happens when you add an energy price surge onto a country with our combination of low growth and high inequality pic.twitter.com/aGh0NVx2nn

— Torsten Bell (@TorstenBell) August 4, 2022

This is a third post in a row provoked by my revulsion for the attitude of pensions people that their customers should not be accessing their pension pots to meet household bills.

Savers do understand they are being shafted by energy prices and the ones that are shafted most are the ones who have least net disposable income. As Torsten Bell goes on to point out in the subsequent tweet.

Low growth + high inequality = poorer households had already seen the share of their spending going on essentials rise from 51 per cent to almost 60 per cent since 2006. Now the cost of those essentials (food as well as energy) are going through the roof pic.twitter.com/W7ThhmMbEb

— Torsten Bell (@TorstenBell) August 4, 2022

If you are in a senior management position in a Regulator, or if you manage an insurer or run a master trust, you are likely to be a flue dot not a red dot. You won’t be stuffing coins or tokens into a meter or worrying as you present your card whether there’ll be enough to pay for your shopping.

For you , in your blue dottiness, the key metric is the average pot size per member, you need that to grow to hit your KPIs. Saving is an end to itself and the spending of pots to meet household bills unconscionable.

It’s the kind of solecism that makes my blood boil. For while pensions people sip their wine and “network” at fancy conferences, the people they are supposed to be managing money for, are staring down the twin barrels of lower take home and higher outgoing. Net result- acute anxiety and physical deprivation. Cold is cold, hunger is hunger.

It’s been fifteen years since the last major recession. In those 15 years, austerity has reduced the standard of living for the red dots but the blue dots have done alright. In most of those fifteen years, the red dots have been coerced into saving for their future through a workplace pension deduction which might as well have been a tax, for all most people know of what happens to their money.

But, and this will be something of a miracle for many people who have not saved weekly or monthly before, the money adds up, even the restricted contributions from auto-enrolment, even the pots that have been denied the top-up of Government incentives by an HMRC too mean to compensate for their own error.

No- most people have been workplace saving now for five years and a large number of the 10m new savers have been saving for up to ten years.

And the ones who need access to their savings are the ones who have least financial capability and are most in need of help.

So what is the reaction of our Pension Regulator? It is to treat those who want to use their pension pots to avoid CCJs, getting cut-off, cold and hunger as part of the pension scamming problem. To make it clear, encouraging people who are 55 and over to draw money from pensions to pay household bills is not pension scamming, it is alleviating hardship.

JRF’s @KatieSchmuecker for @Channel4News:

“We are not even in winter yet and already our survey shows 7 million low income households [going without essentials], over 4 million getting behind with their bills, over a million taking out credit in order to cover the bills.” https://t.co/cbPjf8hJT8

— Joseph Rowntree Foundation (@jrf_uk) August 5, 2022

The “small pot” is relative to your being a red or blue dot

Pots may be “small” where they don’t meet retirement living standards, but £5- 10,000 in pension savings , is a fortune to someone struggling to make ends meet. We are at risk of dismissing the pot of less than £1,000 as “de minimis”. This is not how people in penury see the prospect of hundreds of pounds.

And let me refer you to Alice Guy’s excellent article on the interraction of small pots to universal and pension credits. Some pension experts may have forgotten about the anomaly that you can have cash in a personal pension and not lose universal credit but that cash in a personal pension will be deemed income and restrict your claim for pension credit. TPR – NB – spending your small pot before state pension age, may actually increase your state pension benefits.

The rules are complex but if people get good guidance , they can often claim universal credit and have access to their personal pension. We don’t like to remind those with no money of their rights, but it is often better for people with small pots to spend them before state pension age to avoid losing pension credits and the “door to more”.

Is this kind of guidance coming out of the Pensions Regulator, or MaPS or the PLSA or ABI or out of Nest or Phoenix Insight. NO – these organisations are staffed by blue dots.

I’m close to having a Ralph McTell moment. I want to take the Pension Regulators by the hand and show them round the streets of Brighton, because I could show them something, that could make them change their mind.

The cost of living crisis is a crisis for pensions, a crisis that pensions can help with. But pensions can only help if we recognise that the red dots need our help, and that as blue dots , we need to get off our backsides and make sure they get it.

To be fair to TPR (I hope) they may be talking about scammers that target the under 55s with promises of no consequences pension withdrawals.

You’re right about the potential immediate value of small pots for those, under pension age, in financial need, or crisis. State help for pensioners is much more generous than for people of pension age; personal allowances for Pension Credit are more that twice the amount for those on Universal Credit ( a combination of giving more to pensioners during the last decade and taking a lot away from working age benefits). Small sums, below £6,000 are very likely to be worth a lot more now, in terms of support, than they will be in the future.

Pension Scammers work on pretty high margins – even if they could find a way of liberating pots for the under 55s, would they be able to make much out of such liberation? I’d suggest scammers have got better targets. If there is evidence of ongoing pension liberation, I will eat my words, but this looks like a problem that was acute ten years ago but which is now historic.

Pingback: Cost of living, pensions and some difficulties – Benefits in the Future

Pingback: Cost of living, pensions and some difficulties | AgeWage: Making your money work as hard as you do