For 25 years, “life-styling” has been the accepted wisdom for defined contribution pension schemes in the UK. Pension experts now use the phrase without thought to the confusion of a public for whom lifestyle means something altogether different from the de-risking of pension liabilities.

When life-styling was introduced there were three certainties.

- You knew when your DC pension was going to pay out because you had a “selected retirement date”, you had discussed and agreed this date with a financial adviser, or it formed part of your terms of employment.

- You knew how your DC pension was going to pay out, you had the flexibility to take a quarter of your pot as cash, the rest bought an annuity

- You knew what you were likely to get, because back in the last century we still trusted the projected pensions we received on our pension statements.

In practice, the with-profits pension system which underpinned the majority of retirement annuity contracts (the predominate form of DC pensions till the last years of the 20th century) aped defined benefits and many savers took what they were offered. If you want a demonstration of how this worked, read the opening slides of Saul Jacka’s presentation on regulation, risk and pensions – which deals with the Equitable Life debacle.

Life-styling (or life-cycling as some consultants called it) was the bastard child of guaranteed annuity rates. When insurers woke up to the possibility that the guaranteed terms written into their DC pension contracts could not be afforded, they turned to life-styling as “next best”.

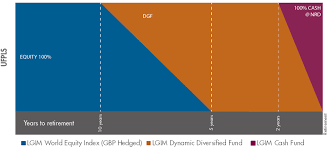

For those not familiar with the concept, life-styling sees your investment fund move from exposure to volatile but fast growing assets, to less fast growing assets which protect you against the uncertainties that lie ahead. This is a typical example of how your investment fund would be reinvested over time

You start with most of your money in volatile but high growth investments (the green bit) and end with most of your money lent to government (the orange bit) with some of your money (the blue bit) available to you as cash.

This was fine and dandy as the orange bit would do fine if the cost of buying yourself a pension (known as an annuity) increased. If pensions were cheap to buy then you had plenty in the pot to hit your expected retirement income and provision had been made for you to take your tax-free cash by ensuring that some of your money wasn’t invested at all, but held in cash deposit funds.

But here the certainty ended

Life-styling was fine so long as DC pensions were simply aping DB pensions and people had those three certainties in their heads. Life-styling wasn’t as good as a guaranteed annuity but it was second best and certainly justified to the regulator the high fees pension providers were charging for their services.

But then the old certainties fell away – one by one.

The first of these certainties was that you would take your retirement at your selected retirement date. To be honest, nobody actually believed in the selected retirement date idea, it was simply a good way for insurers to lock you in to their products and an easy way for advisers to work out how much commission they were due. Employers didn’t really believe that people would leave them when their defined contribution pension became due. The idea of the selected retirement date was half baked, most lifestyle strategies were set on a false premise of certainty.

The second certainty proved equally fallacious. In 2014 the Chancellor famously stated that from the day of the budget “no one would ever have to buy an annuity again”. The certainty on which life-style had relied – that people would need protection from fluctuating annuity rates, was pulled like a magician’s table-cloth, from under the DC endgame strategy.

Finally, and this resulted from more than market volatility, the concept of a projected benefit, fell into disrepute. Confidence in the certainty of pension pay-outs had been undermined for some time, scandals such as Maxwell’s theft of parts of the Mirror Pension Scheme had started it and the Equitable Life showed that even the most reputable DC provider could get it very wrong. But for most of the new-style personal pensions (introduced in 1988) there was no guarantee in the first place, savers had to rely on their provider’s best endeavors and the help of a financial adviser, who was rarely seen after the sale of the original policy. People started looking at their pension illustrations with increasing frustration and in the end they just threw them in the bin.

Certainty collapsed – but life styling persisted.

Despite the advent of pension freedoms, the collapse in annuity sales and the increasing loss of confidence in pension outcomes, pension providers have persisted in life-styling as a means to provide people with certainty. The old matrix was adapted to meet the new world with diversified growth funds replacing gilt funds as the secret sauce.

Some advisers gave up on the idea of a pension altogether and created life-styling that led to 100% of the fund being taken as cash. This matrix is from UBS and comes with a DIY questionnaire to help you work out how you can be sure of what you are doing

Other providers , more confident that their policyholders would get advice, created multiple life-styles to meet the various certainties that could be entertained.

The concept of life-style was morphing into investment glide-paths with ever more complex investment solutions being proposed.

Behind all these different ideas, was the old certainty that people’s pension pot could provide more certain outcomes, with the help of a good pension provider. Life-styling remains at the heart of the “pre-retirement value proposition”.

Life-styling has become little more than a façade

If we follow the journey from the certainty when DC started, back in the 1970’s through to today, we can chart a slow decline in certainty of outcomes but an ongoing level of confidence from the marketing departments of pension providers that their products will deliver certainty. Investment pathways are just the latest iteration of this façade of self-confidence that could be described as a confidence trick.

In reality, most people take their pension pots when they need the money and are primarily concerned to avoid a tax-bill than to ensure their pension pot lasts as long as they do. They draw their savings down with no certainty of the price they will get on their units and even when they get their money, they have no idea how their units were valued at claim.

The funds that are being claimed on today by the over 55s are not being converted into annuities, despite many of them being invested in annuity protection funds. The funds that are not being drawn down, are often in the process of purchasing gilts which are paying negative yields and serving no purpose at all. The vast majority of life-styling going on today, is happening with no adviser in sight and the consequences of automated investment decisions are not being explained to the savers.

This state of affairs has been recognized as unsustainable by the FCA who are trying to stick a finger in the dyke by introducing investment pathways from February 2021, but the new glide-paths are little different from the old lifestyle matrices.

Time to come clean with investors

We need providers to level with investors and accept that the old certainties do not exist, that life styling is a sham and that the only thing certain is that people are going to have to work things out for themselves. Providers may point to the availability of advice, but the majority of DC savers will not take it as it is “not for them”. Advisers aren’t in the market for those without six figure pots and those without six figure pots can’t afford the advice on offer.

This is the current state of the DC market and it is ripe for an innovation. By the end of this year we will have legislation in place that could and should lead to a new kind of retirement option for those with DC pots. It will not provide false hope through guarantees nor will it provide spurious certainty through lifestyle de-risking. It will provide non-guaranteed pensions based on the best endeavors of pension managers and it will be called CDC.

Target pensions

It does seem to me, Henry, that there is a basic flaw in the way our pensions are set up, invested and paid out. There are two things that industry and government ignores. Firstly, pensioners are the ones who have time on their hands and can therefore travel, use the leisure industry and shop. Secondly, if pensions are not high enough, workers won’t retire and so there won’t be jobs for young people. The result of these two things will be that various sectors of industry will die (and then where will your fat salary come from Mr CEO?) and the bill for supporting the unemployed will go through the roof, and guess who will end up having to pay the bill Mr CEO? It certainly won’t be us poor pensioners!!