Professor Dennis Leech is Emeritus Professor of Economics at Warwick University. This week has seen the University Employers threaten to withdraw sponsorship for future DB accrual, the University Union announce intended strike action and the DWP Select Committee ask fundamental questions about how Defined Benefits are promised. Professor Leech’s contribution the debate is the more timely and valuable than ever.

Professor Dennis Leech is Emeritus Professor of Economics at Warwick University. This week has seen the University Employers threaten to withdraw sponsorship for future DB accrual, the University Union announce intended strike action and the DWP Select Committee ask fundamental questions about how Defined Benefits are promised. Professor Leech’s contribution the debate is the more timely and valuable than ever.

Threat to the defined benefit pension scheme

The employers have said that they want to close the USS defined benefit pension (DB) scheme to future accrual, which means that new members will not be allowed to join, and existing members will not be able to contribute any more into it than they have already built up. Future pensions contributions will all go into a defined contribution (DC) pension pot via the Investment Builder.

Defined benefit pensions are much cheaper and less risky

This is a very bad decision because DB pensions are much better than DC ones. They are a guarantee of a secure ‘wage’ in retirement for life, whereas a DC pension scheme works differently: it gives a single sum of money on retirement which you have to turn into an income. And pension freedom puts you in the position of having to take some very serious decisions about what to do with this pot of money that will affect the rest of your life. A lot can go wrong, especially as a result of poor financial advice, and you may have to live out your retirement with the consequences of one bad decision.

A DC pension is risky because how much your ‘pot’ is worth depends on the vagaries of the stock market. Academic research has shown that it costs between fifty percent more and double to provide a given secure income in retirement via a DC pension scheme than DB.

Essentially, there is less risk in a DB pension because of the collective nature of the scheme. None of us knows when we will die, which is the biggest risk facing us if we are having to live off a DC ‘pot’: if we do our ‘drawdown’ sums wrong we might run out of money before we die, or leave unused retirement money as an unplanned legacy if we die earlier than planned. (It is actually rather far fetched to believe we can plan for our retirement in this way.) But actuarial life expectancy tables solve this problem in a DB scheme: the longevity risk is simply pooled.

Likewise it is much less costly to build up a DB than a DC pension because the investments are pooled in a large diversified portfolio, exploiting economies of scale and the law of averages which are not available to a DC fund.

A pension is a ‘wage’ in retirement for life. A DB scheme is designed to provide that while a DC pension does not. A DC scheme is really an employer-subsidised saving scheme. How you turn the savings you have built up into a pension is another matter that you have to decide and that is not easy or cheap.

The source of the problem facing USS

Contrary to what a lot of people think, the USS is not a government scheme backed by the taxpayer, like the teachers, civil service, health service and others. It is a private scheme run and regulated like a company scheme. It comes under the Pensions Regulator in the same way as, for example the schemes at BT, Royal Mail, British Steel, BHS, etc. Like all these it is ‘funded’ which means, in effect, that it must stand on its own feet, that its trustees must be able to show the regulator that it will have enough funds to pay the pensions members have been promised and expect every month after they have retired.

The source of all the controversy about valuing the scheme is the interpretation of the phrase ‘enough funds to pay the pensions’. Does that mean a capital sum or a flow of income? The difference has a big effect on how much risk there is.

The UUK have said the scheme must close because it is in deficit, the deficit is growing and that is unsustainable because it means the institutions will have to make ever larger recovery payments.

Let us examine the claims of the UUK. First, the scheme is not in deficit in the ordinarily meaning of the term. Second, there is no evidence that investment returns are too low for the scheme to be sustainable. Third, the scheme is sustainable as long as it remains open and continues into the future along with the universities it serves. Fourth, it is highly questionable that there is a deficit even in the narrow technical meaning in which the word is being used here.

Where is the deficit?

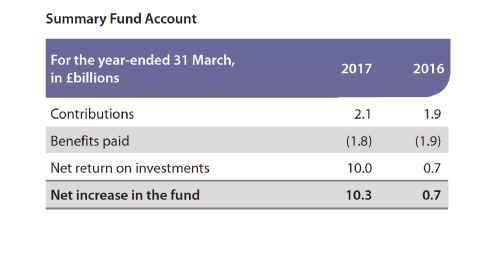

Figure 1 (below) taken from the USS Annual Report for 2017 shows the income from contributions and investments and payments of benefits. It shows that there is not actually a deficit in the usual meaning of the word. Income from contributions by employers and members totals £2 bn, while pensions in payment come to £1.8 bn. In addition it made a return on its investment portfolio of £10 bn (mostly this was from market price movements but that figure includes over £1 billion in dividends, interest, rent etc.).

We usually think of a deficit in the George Osborne sense of not enough money coming in to pay the outgoings, necessitating selling assets or borrowing more. The USS is clearly not in deficit. It is cash rich and every year investing its surplus in new assets such as Thames Water, Heathrow Airport, and many other infrastructure projects in addition to traditional assets like company shares and bonds.

Figure 1: Deficit?

Will there be a deficit in the Future? Here we must enter the realm of intellectual speculation and deal with economic theorising, market fundamentalism and evidence-free opinion

Looking at one year’s figures is not enough since they may not be typical and we need to look into the future. We need to find a way of seeing if there will be enough money to pay the pensions when they come due.

It is not obvious how that can be implemented. We have to do a thought experiment.

Consider a pension payment to a young lecturer early in his or her career, when he or she has retired, say in 50 years from now. There has to be enough funds to pay that. The pension can be forecast on assumptions about longevity, salary growth, inflation and other factors. But how can we tell if will be enough money? One approach is to ask how much will be needed to be invested today to give enough in 50 years to pay the expected pension.

Since the trustees have to be sure that the money will be there, they must be prudent in their assumptions. How prudent is prudent enough? Since nothing is ever certain, if they wish to be very prudent, they cannot rely on contributions from employers or members in the future. Theoretically the scheme could close (maybe all the member institutions go under for some reason we do not yet know) and there could be no contributions. So it is arguably best to err on the safe side and make this assumption.

And they have to decide how the money is invested to pay the pension in 50 years. Since nothing is certain in investments it would be imprudent to rely on risky assets like equities, even though they are almost certain to grow handsomely in a long enough period. Prudence – paradoxically – requires investing in secure bonds, which have a poor rate of return. At the moment the rate of return on government bonds is at a record low level due to the government’s policy of quantitative easing.

If we do this calculation for all prospective pension payments, we get a figure for the liabilities. Comparing that with the value of the assets the scheme owns gives the funding level or deficit/surplus.

The liabilities figure is very large because it is based on the very powerful arithmetic of compound interest over long periods of time. It is also very sensitive to assumptions made – for the same reason. And it must ignore a host of real world factors that can change dramatically. The figure for the deficit is very inaccurate and volatile since it is the difference between two very large numbers, the liabilities and the assets, both of which are highly volatile. The deficit figure quoted by the UUK and USS executive has changed by over £2billion in little over two months. This fact alone suggests that this way of valuing the scheme is unreliable: the actual value of the benefits can not have changed in that time by more than a miniscule amount.

Another other problem with this approach, that has not been sufficiently discussed, is that it begs the question of how the capital value of the assets is to be converted into money to pay the pensions – that is, an income stream. That process needs to be spelled out and not just assumed. Can a scheme as big as the USS just sell assets on a large scale if need be without disturbing the market? It seems unlikely.

Are investment returns really too poor?

The UUK give one of the reasons for the deficit that investment returns have fallen. It is certainly true that gilt rates are at the lowest they have ever been, lower than inflation. It would not really be sensible for a rational investor to invest in gilts since that would guarantee losing money. But other investments, particularly equities, produce a good return that would seem to be enough for the pension scheme to continue to be viable, if it continued to invest in them.

Figure 2 below shows the estimated returns on different investments that were prepared for the UCU by its actuary, First Actuarial. They contain a suitable margin for prudence to enable them to be the basis of a discount rate. The returns have fallen dramatically to low levels on bonds particularly government bonds.

Figure 2: Poor investment returns?

Is the USS unsustainable?

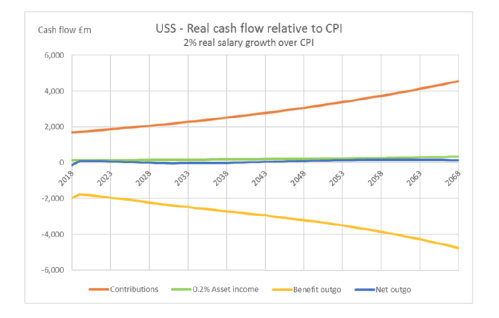

Another thought experiment is to ask if there is likely to be enough cash flow to pay the pensions, based on a projection of income from contributions and investment earnings and liabilities. This is a natural, direct approach that requires less in the way of assumptions than the capitalisation approach described before. In particular it does not require a discount rate for compound interest calculation.

Figure 3, below, shows projected cash flows for the USS that have been prepared for the UCU union by its actuaries (First Actuarial). This is just one of a number of scenarios that have been studied but all show the same picture (2% real salary growth, real asset income of 0.2 percent). It is clear that from this point of view, where the scheme remains open indefinitely, in the same way as is highly likely the pre-92 university sector will, the pension scheme will be perfectly sustainable, having a small deficit or surplus.

Figure 3: Unsustainable?

Is the scheme in technical deficit or is it in surplus?

There is a fundamental difference in the methodology between the situation where the scheme is assumed to be open indefinitely and where it is assumed to be getting prepared to close. In the latter case it must find a way of ensuring it is funded at all times, or at least as soon as possible while it can rely on the employer being able to support it. Volatility of the technical ‘deficit’ due to market fluctuations in asset prices represents risk here. The risk is that the scheme will close and the valuation will crystallise with assets values low due to a depressed market, such that they are inadequate to pay the liabilities. Hence the need for recovery payments to meet the cost of covering this risk.

On the other hand, if the scheme is open indefinitely with a strong covenant, it can be assumed it will never need to close. Therefore asset price volatility is not important. The ability of the scheme to pay benefits depends on there being sufficient investment and contribution income coming in. Therefore market volatility is not a source of risk. There is much less risk and therefore the scheme is cheaper because there is no need to cover it. Also the scheme does not need to invest in ‘safe’ assets like gilts for the same reason. An open scheme can, and should rationally, invest in assets that bring the highest return.

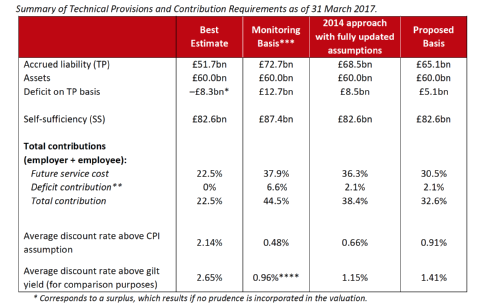

Figue 4 below (from the Technical Provisions Consultation document, September 2017) is the analysis, by the USS executive (not the UCU actuary this time, but the USS exectutive itself under its requirement to provide a fair view of the scheme), of the ‘deficit’ based on these two different assumptions. On the assumption that the scheme may have to close and therefore must be extremely prudent, so called ‘gilts plus’, which is the proposed basis, the ‘deficit’ is £5.1bn. (This has been changed since the TP document was published and is now £7.1 bn. The fact that these figures are so very volatile, with pension liabilities which change very slowly over decades being valued at amounts varying from month to month by billions calls into question the whole methodology.) On the other hand, if the scheme remains open, there is no need to apply a great layer of prudence to all the calculations, and the valuation of the liabilities can be done using the ‘best estimate’ of the investment returns as the discount rate. On this basis the scheme is massively in surplus, to the tune of £8.3bn!

Figure 4: ‘Deficit’ or ‘Surplus’?

All the efforts of the scheme trustees, the employers and the Pensions Regulator should be devoted to ensuring the scheme remains open. The biggest risk comes from the deficit recovery payments calculated on the basis that the scheme might close. It is therefore a self-fulfilling prophecy. If the scheme is assumed to be ongoing and open then there is little risk.

Risk is not an absolute exogenous quantum as some suggest. It is contextual. And assumptions about it are self fulfilling. The problem with the methodology that is being used is that it is based on an assumption that risk is the same in all circumstances. That is a theory which is false empirically.

Why can’t the Pension Protection Fund help?

What is puzzling is that the methodology takes no account of the safety net provided to all pension schemes by the Pension Protection Fund. The USS contributes its share of the levy to this government scheme which guarantees pensions in payment and ensures active members will receive pensions at 90 percent of the DB scheme level.

Why does the USS valuation ignore this? It seems directly relevant since it manifestly limits the risk.

It is said that if the USS entered the PPF it would be too big for it. But the PPF would take on the assets as well as the liabilities. Since the PPF is a government body there can be no problem of it failing to support the schemes in its portfolio, as there is with a private sector employer with a weak covenant. There is no problem with short term market volatility posing a risk.

Therefore we can argue that because the USS is protected by the PPF, a statutory body supported by government, the greatest part of its risk is removed. The valuation should therefore be done without such a large amount of prudence, and therefore the deficit will be much smaller or non-existent. Therefore the scheme is not in danger of failing and of having to enter the PPF.

Can anybody explain why this argument is not being used?

What an excellent clear explanation by Professor Leech. I now wish I had paid more attention in his lectures! It would be interesting to.see a response to Professor Leech’s question as to why the PPF protection is not being considered.

The PPF is not government guaranteed as Professor Leech says. This is from the PPF’s own website: “Is the PPF taxpayer funded?

No. Compensation, and the cost of running the PPF, are paid for through levies

on eligible pension schemes, income from our own investments, taking on the

assets of schemes that transfer to the PPF – and recovering money, and other

assets, from insolvent employers of the schemes we take on.

Is the PPF state-backed?

No. We are a public corporation, set up by the Pensions Act 2004, run by an

independent Board which is responsible to Parliament through the Secretary of

State for Work and Pensions.”

Here is the link: http://www.pensionprotectionfund.org.uk/DocumentLibrary/Documents/common_misconceptions.pdf

Brian – it’s a great read – but your comments on this blog have been equally clear and have added to my understanding. I’ll be posting later today on one of the ideas you have posted on here. Thanks very much for your contributions.

“Can anybody explain why this argument is not being used?”

Prudence is used by the trustees and by TPR when overseeing trustees’ assumptions.

How it is defined seems to be one of those judgment calls around which there are a range of views.

The infamous Charles Cowling/Staple Inn presentation suggested (the reference is a table in 9.2.9 which also uses TPR’s 4-level covenant strength) between 60% probability and 90% (!) probability of achieving investment returns.

But this is applying fractions to estimates when facing uncertainty.

Perhaps the FRC should opine on what the ranges should be in different circumstances? The FRC also sets (and updates) the actuaries’ Pensions TAS teporting standards, which used to show actuarial

estimates of the difference between prudent assumptions in any particular case and what the sctuaries considered to be “neutral estimates”.

The actuarial profession didn’t help itself by choosing “neutral” estimates when everyone else uses “best” estimates with a supposed 50+% probability.

Are they the same thing?

As for why trustees can’t factor the PPF safety net into their funding strategy, there is High Court (only) case law – Independent Trustee Services Limited v Hope and Others in 2009 (aka the Ilford Pension Scheme case).

This is a long comment, in two parts. The first part began life as a submission in response to a recent Institute and Faculty of Actuaries sessional paper: “Funding defined benefit pension schemes”

Part One

In that paper, the authors note, correctly, that the scheme specific funding legislation does not refer to paying (future) pensions as they fall due. Indeed, nor does the Pensions Act 1995. They find, correctly I believe, the original reference in actuarial literature to such an objective in McLeish and Stewart (1987): “the prime purpose of funding an occupational pension scheme must be to secure the accrued benefits, whatever they might be, in the event of the employer being unable or unwilling to continue to pay at some point in the future.” However, they fail to note that this is merely an assertion, presented without supporting evidence or even argument. It was also challenged at the time.

This paper also asserts that one of the two objectives of a pension scheme is: “Financing a long-term obligation – funding benefits as they fall due”. USS’s self-sufficiency ambition is an example of this type of objective; it places an unnecessary cost burden on the scheme.

There is, in fact, a very good reason for the absence of any prospective “as they fall due” requirement: it is that such an obligation could breach the fundamental English law principle of equity. Under current valuation methods, it is probabilistically certain to do so.

It is notable that the Pensions Regulator has introduced the concept in much of its guidance. The Pensions Regulator has a long track record of introducing obligations through “guidance” onto scheme trustees that are unsupported by UK legislation; other examples were integrated risk management and the sponsor covenant. If we are to believe the accounts circulating, it appears that the Pension Regulator has introduced another; that it may veto the trustees’ and employers’ considered calibration of the expected return on assets, the discount rate central to valuation and contribution-setting. This is considered more fully in Part Two of this commentary.

The Pensions Regulator has avoided describing such a prospective obligation as a trustee obligation, as it repeatedly describes their duties under trust law as:

(1) To act in line with the trust deed and rules;

(2) To act in the best interests of the scheme beneficiaries;

(3) To act impartially; and

(4) To act prudently, responsibly and honestly.

This obscures the operational duties of trustees and the “as they fall due” issue. Trustees have just two relevant operational functions:

(1) To agree and collect contributions in respect of new awards;

(2) To secure the equitable entitlements of members.

The equitable entitlement of any member is determined by the first of these. The contribution and projected pension benefits determine a contractual accrual rate; that is to say the rate at which an entitlement will accrue over the term for which the pension liability is outstanding. It is incidentally the rate required for all benefits under an award to be discharged fully as due.

This contractual accrual rate is the investment return guaranteed by the sponsor employer.

Given these rather limited powers, it is difficult to see how and/or why the infamous three tests of came to be accepted by the trustees.

The amount of the security, the level of funding, required in a scheme is simply the aggregate of members’ equitable entitlements. Note that this has no dependence upon either expected returns or gilt yields – the counterfactuals which currently pass as valuation methods.

Prudence may be contained within this equitable interest valuation, but it would operate through the terms of the ultimate pension benefit projections, the true risk factors of a DB pension.

It should be noted that it is no part of the proper or ordinary business of a company to make provisions for events which may occur after its insolvency. Its obligations are limited to performance of contractual obligations incurred and accrued to date. It is as unthinkable for a company to over-fund a pension scheme, relative to the equitable value, as it would be for the company to “put aside” funds for the payment of dividends to shareholders after insolvency.

It is worth noting that funding to the level of USS’s technical provisions, where the excess above the best estimate of liabilities might be considered as equivalent to equity capital in an insurance context, would place USS in the top five percent of life companies by balance sheet strength.

If a sponsor company is to fund a scheme above the level of the contractual accrual, then it needs to be able to defend that decision and action in terms of an equivalent equitable benefit to the other stakeholders of the sponsor company. Few can do this. For most the difference in return expectations between investment in the firm and further investment in markets, through the scheme’s fund, makes the construction of such a defence an almost insurmountable barrier.

In the case of USS, there is no attempt at such justification, rather it is the members of the scheme who are being expected the costs, through scheme closure. In essence this amounts to the employers requiring members to bear the costs of extricating them from their prior guarantees of the investment performance. This guarantee is the absolute core element of a DB pension. Indeed, the three tests may be seen as an attempt to limit or restrict the unconditional nature of that guarantee.

In reality, rather than the narrative promoted by the Pensions Regulator, and well-expounded by Dennis in his blog, the trustee concern with the sponsor covenant is extremely limited, as the exposure consists solely of uncollected, unfunded deficits relative to the equitable valuation. Very, very few of the nearly 6,000 remaining DB schemes are currently in deficit on this basis. USS is in surplus.

When a scheme is funded or secured to the equitable level, the member has complete performance of the promise as made by the sponsor employer and accepted by that member.

It is also interesting that much of the concern that prompted so much change in regulation, including the Pensions Regulator, was another breach in the principle of equity; the practice of meeting pensions in payment in full at the expense of other classes of scheme member. Indeed, it could be argued that all that has been achieved by all of this legislative and regulatory activity has been the exchange of one form of breach for another.

The prospective “as they fall due” idea is clearly well-intentioned, but, when combined with the counterfactual valuation methods specified by the scheme specific funding legislation, produces most of the so-called crisis of DB pension provision. The consequences in terms of corporate finances, investment and economic performance are far wider and more significant than any benefit to scheme members. It seems that the road to perdition really is paved with good intentions.

An afterthought arising from the paper’s Staple Inn presentation.

The question of feasibility of the prospective “pay pensions as they fall due” funding objective must arise given the timespans involved with DB pensions. A pension is economically simply a claim on future production and the financial assets we acquire today represent (partial) claims on that future production. They are a small part of today’s production and likely to be far smaller in the future. At the time horizons concerned, we really are dealing with imponderables. Uncertainty rather than risk. At the very least, as time passes and information unfolds, some process of transition from today’s producers to tomorrow’s will become necessary. Nor can the sponsor covenant be reliably forecast over those terms. As the sponsor employer is a singular risk, with funding we do not have the luxury of probabilistic pooling to offer comfort and support. This suggests most strongly that if we wish to secure pensions beyond sponsor insolvency, we would need to move away from funding into the realm of pension indemnity assurance.

By contrast, in the contractual accrual world described earlier, the level of funding is simply the current collateral held in support of member’s equitable interest at that time, which is clearly feasible. The downside is that it may prove insufficient to buy replacement pensions in the “market” but over more of DB history than not, this would have been more than adequate.

Part Two

The response of the trade union, UCU, to the proposal to close the USS DB scheme has been to call a strike ballot. This has been followed, rather conveniently for the employer, by the circulation of a meme, in a series of Chinese whispers, to the effect that: The big problem for the UCU now is that the intervention of the regulator saying that nothing except gilts plus methodology is acceptable to her makes everything seem hopeless. Going on strike for something that is impossible for the employers to offer seems futile.

If true and enforceable, this should be expected to lower support for strike action. If the Regulator has made such an intervention then it should be published. If it does not exist, then it can be seen for what it would be, an attempt to distort a democratic ballot – in the best traditions of autocratic interventions. True conspiracy theorists would see the existence of such correspondence as connivance between UUK and the Regulator – which would, of course, open the prospect of remedy through a suit for maladministration. It is arguable that this could succeed even if uncoordinated and unintentional.

There appears to be nothing in pensions legislation which grants the authority to the Regulator to specify the manner in which the discount is set. This conflicts with their statement: “We regulate according to the legislative framework set by Government and Parliament.” If the Regulator were to be intervening over the quantum, then it is on very dangerous ground. The differences under discussion are well with the differences that may exist between rational men acting in good faith. The Regulator has no crystal ball, no significant investment in economic and financial forecasting, and such action would breach their primary objective, to protect member benefits.

The forecasting difficulties are well-known. It happens that this week saw the BIS publish a survey paper: “Asset prices and macro-economic outcomes”. Among its conclusions are:

“The links between asset prices and activity differ from the predictions of standard models in a number of ways. First, asset prices are much more volatile than fundamentals would imply and can at times deviate, or at least appear to do so, from their predicted fundamental values.

The term structure of interest rates is not fully consistent with the simple expectation

hypothesis. Although exchange rates can be modelled as the present value of

expected fundamentals, they appear to be overly volatile, as is the case between

equity prices and their underlying dividend streams (the puzzle of “excess volatility”).

Moreover, macroeconomic and financial news seem to have an exaggerated effect

on asset prices: equities, bonds and currencies overreact to news about cash flows

and other fundamentals. (emphasis added)

… Research also questions the strength of the direct impact of interest rate changes on activity and highlights its dependence on the state of the economy and the financial sector, and institutional arrangements.

Recent studies emphasize the importance of uncertainty (measured among others by

the volatility of asset prices) in explaining macroeconomic outcomes.

Third, there are limits to the predictive ability of asset prices for real activity. The

basic theory implies that asset prices should be good proxies for expected growth as

they are forward-looking variables. Equity prices, however, with their low signal-to noise

ratio and their (excess) volatility, have a mixed record in forecasting activity.

There are also limits to the predictive ability of the yield curve, which depends on the

time horizon, country-specific circumstances and external factors. (emphasis added)

There is much more that might be said, but that will have to wait for a fuller academic paper, which is in preparation.

“…we can argue that because the USS is protected by the PPF, a statutory body supported by government, the greatest part of its risk is removed.”

Because USS is ‘last man standing’, the pensions protection fund is almost irrelevant to it and the levy charged to this huge scheme is much lower than it would be if USS were not last man standing. According to USS’s Accounts, the annual levy is about £3 million. USS has estimated that this figure would be about £30 million, if they were not last man standing.

Every single employer would need to become insolvent before USS becomes eligible to enter PPF. That is why USS says the following in its post for deferred and retired members:

“…as a deferred member (no longer paying in to the scheme) or a retired member (already in receipt of your USS pension), it is important for you to know that your benefits are secure. The law means they cannot be reduced as a result of any discussions around the valuation. It would require all of the employers supporting USS to become insolvent before there was any prospect of your pensions being affected.”

The “prospect of your pensions being affected” is the reduction of pensions in accrual to 90% and the capping of CPI inflationary increases to pensions in payment by 2.5%.

An upshot is that PPF does not protect against a scenario in which the valuation methodology so inflates the liabilities, relative to mark to market value of the assets on 31 March 20XX, that the required deficit recovery plan renders up to but not more than 99% of employers insolvent.

‘And they have to decide how the money is invested to pay the pension in 50 years. Since nothing is certain in investments it would be imprudent to rely on risky assets like equities, even though they are almost certain to grow handsomely in a long enough period. Prudence – paradoxically – requires investing in secure bonds, which have a poor rate of return.’

This is accurate enough as a statement of what changes imposed on pension funds imply for funding and investing but the logic is flawed when it comes to what constitutes the bad outcomes that funding and investing need to deal with. Yes, you can notionally fully fund all liabilities at every term without market risk but only using fiat government securities that are themselves underpinned by market (or economic or business) risk. If private risk capital is not adequately rewarded for long periods, and not provided by other investors, governments will not be able to meet their obligations. Everything depends on business (collectively) adapting and surviving. Pascal’s Wager has more to offer by way of explanation. There is no paradox, only hard logic.

It’s a moot point how low equity returns would need to be and for how long before triggering the default of risk free assets. But with negative real yields and equities quite close to their long-term regression trends, and allowing for high and time-dependent equity real-return risk, the worse-case (but in a Pascalian sense sustainable) equity return range is probably entirely above the risk-free rate for most of the 50-year term quoted. No wonder individuals want to transfer out of DB scheme if this is the bet they are intuiting.

Am I alone in finding both Con’s and Stuart’s contributions above a little hard to follow?

If pension trustees default to (government) bonds, are they not placing too much faith in future taxation and/or yet more gilt issues (government borrowing) to earn redemption?

I think this is one of Stuart’s points, that there need to be taxable returns to private risk capital to square the circle?

Too many of those potential returns seem to me, however, to be leaking out as industry costs. And how much of intermediaries’ income and share of gains are being diverted offshore? At least any net returns accruing in onshore pension funds are (for now, anyway) tax free.

Blaise Pascal, for all the charm of his completed writings, advocated an austere form of Christianity which reflected both his own deep inner tensions and the radical pessimism of Jansenism. Coincidentally, Pascal’s father was a tax collector!

In Pascal’s day, however, prudence may (if Wikipedia is to be trusted for once) have been taken to mean the ability to judge between virtuous and vicious actions. Although prudence of itself does not perform any actions, and is concerned solely with knowledge (ie where necessary, taking advice, but also knowing when to stop taking advice and take action, avoiding analysis paralysis), all other virtues had to be regulated by it.

Distinguishing when acts are courageous, as opposed to reckless or cowardly, is a judgment of prudence, and for that reason prudence is classified as the pivotal “Cardinal” virtue.

Whither trustees’ virtues?

Thanks for that scholarly post George – i am going to spend some time now unravelling the thread!

The PPF is not government guaranteed. This is from the PPF’s website:”Is the PPF state-backed?

No. We are a public corporation, set up by the Pensions Act 2004, run by an

independent Board which is responsible to Parliament through the Secretary of

State for Work and Pension”.

2 questions if I may Henry.

i) Why is the prudent return for overseas equities so low, or at least lower than UK?

ii) Do you think the vast levels of employment by Universities (and therefore contributions) will continue. Personally I think Universities are ripe for some staffing reductions which will throw a spanner in your projections.

i) It looks like the equity return is estimated as dividend+inflation+change in exchange rate. I assume this means that dividends are reinvested and company growth keeps pace with inflation. To start with, this seems an under-estimate as it ignores real growth in the economy.

However, US companies (about 50% by weight) don’t pay large dividends like UK companies, but rather reinvest or return capital through share-buybacks as that is more tax-efficient for them. Many of the high-growth techs don’t pay any divided, nor did Microsoft (for example) for many years. So overseas equity return is systematically underestimated.

Perhaps earnings yield (the inverse of P/E) might be a better estimate of return than dividend yield for this purpose?

Alan, sorry to have not reached your question till now. Richard, thanks for answering it . We will hear today the Prime Minister’s plans for Universities – they may have an impact on this debate. Richard, thanks too for your comment on Mike Otsuka’s post, I take your comments and you might like to read today’s blog.

Pingback: Why the UCU strikes are bound to be insufficient to ensure equality | Policy Press Blog

Pingback: Thoughts for UCL (and perhaps other) students about the pension strikes at universities | SellaTheChemist's Occasional Blog