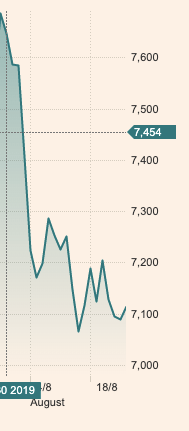

One of the things ordinary people find hardest to work out is why their share of a defined benefit scheme can go up when stock markets go down. This happened last month where the stock market fell.

FTSE100 in August 2019

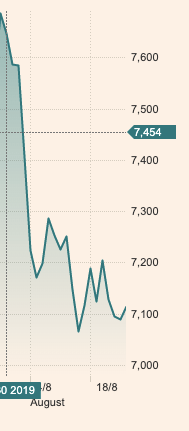

But in August, the 10 year Government Bond yield fell yet again

10 year bond yield (FT)

Most people understand a transfer value to be a “share of the fund” and most people think that pension funds invest in company’s shares. Both thoughts are a little askew.

Firstly , defined benefit pension funds do not pay out a share of the fund, they pay the estimated cost of meeting the promise made to you, based on the actuary’s estimate of the liability (your pension) and of the cost to the fund to pay it.

Most pension funds are now largely invested in “risk-free investments “, by “risk-free” experts mean investments which aren’t impacted by market conditions – in terms of meeting liabilities, pensions funds regard an investment in Government Bonds as risk free.

So a stock market in free-fall no longer impacts pension funds that much. Our transfer values are immune from crashes in equities. Infact transfer values can benefit from market crashes – as money is swiped into gilts, pushing down gilt yields and increasing the price at which gilts need be purchased.

The transfer value represents the amount of cash that would be needed to pay the pension (it’s often called the cash-equivalent transfer value) and when gilt yields fall, the amount of cash needed to pay the pension rises. That’s because the gilts which are yielding less are more expensive to buy.

I know it sounds crazy, but last month your DC pension probably dumped in value but (if you had one) , your DB pension went up (in terms of its transfer value).

Does this make sense?

We are in a world of extremes. Politically we are in the middle of a trade war between the USA and China and a political struggle between Britain and Europe. These big (macro) events are know as “geo-political” tensions and they cause markets to put tin-hats on. Shares are sold off and money invested in risk-free assets, markets seek the strongest currencies (the pound is not one of them) and the fundamental state of economies is ignored for fear of how these economies will change if things go badly wrong.

Does this make sense? Markets are a law unto themselves, they cannot be controlled by central bankers and politicians, though such people’s actions can influence markets in the short term.

In short, you are – in terms of your pensions, in the hands of irrational forces that defy your prediction.

People who were advised last year to transfer may now be wishing they’d hung on a year. Over the past year, the FTSE 100 has fallen 6% , but according to pension consultancy XPS

The continuing fall in gilt yields has pushed transfer values to new record highs, around 10% higher than they were this time last year. Although there is a lot of uncertainty around the future of the financial markets, an increase in transfer values will mean we are likely to see a lot of members investigating their options.

Why do I feel a little queasy?

I feel a little sick of speculation about DB transfer values; I’m not the only one. Recent FCA papers warn that many transfers are wrongly advised, there is insufficient reason for people to be transferring to warrant the loss of guarantees inherent in the pension given up.

And yet there is still a view among those who advise pension fund that the payment of transfer values actually helps a pension scheme. There is something in that final sentence that makes me feel sick

…we are likely to see a lot of members investigating their options.

I am not in any way accusing the statement’s author , XPS’ Mark Barlow of encouraging transfers, but anyone who has read this article will realise that the temptation to go for a transfer today is higher than it’s ever been – transfer values are at record levels.

The reason for these high values is – as Barlow also says, because scheme liabilities are valued using the return expected from the scheme’s fund and that return trends towards the return (or yield) on Government Bonds (gilts).

This is an entirely artificial situation, created by the mania to match liabilities with risk-free assets. It is the by-product of financial economics which uses theory and ignores practice. The theory is that schemes dump risk, the practice is that risk is dumped on members. That is why I feel queasy.

Enhancing Transfer Values with no capacity to transfer

And the worst of it is this. If you do as a DB member with a CETV, investigate the option to transfer, you will find it increasingly hard to get financial advice.

Financial advisers who can give advice on transfers (about one in three regulated) are often subject to quotas imposed by Professional Indemnity Insurers, many firms with capacity to advise have withdrawn from doing so and some firms have been stopped from doing so by the FCA.

The member tempted to investigate options is now facing a frustrating task. Though he and she may see good news in the CETV increase, they may face more obstacles than ever in taking money.

For the first time, I sense that actuaries are waking up to the consequences of the de-risking they have watched happen (and often advised to happen). Mark Barlow’s statement this month ends

“Trustees and sponsors should ensure that members considering long term irreversible decisions are being provided with sufficient education and support to enable them to make the right decision for their circumstances and financial futures. We would also recommend schemes consider how the substantial changes in market conditions have affected the funding strategy and whether, in light of this, the transfer value basis remains appropriate.”

This is a coded way of saying that the consequences of de-risking may not be as great as we thought. That pension schemes have a social purpose and that at the moment, the way they offer transfer values is causing moral hazard – it’s encouraging the very behaviours that the FCA are trying to prevent.

Actuaries only follow rules when they increase transfer values at times like this, but the transfer value basis – fair as it seems to actuaries – may not be fair to members. Dangling carrots and then locking the carrot away, is no way of managing people’s retirement planning.

An awkward state of affairs.

I think the current state of affairs is best described as awkward. There is no easy way to talk to members about what to do. The head says sieze the opportunity – but the heart says stay where you are. The head says use the contingent charge, but the heart says, enjoy your pension. I could easily turn these formulations round, for some the heart yearns for freedom and the head says no.

And for those who took transfers – the £60bn of us, between 2016 and today, those transfer payments may not be looking quite as healthy as we they did earlier this summer.

How resilient do we feel looking at this chart?

I feel queasy, I feel awkward, so I think does Mark Barlow and so do many actuaries who value pension schemes.

The question is just how sick do you have to feel, before you get off the boat.

Henry, you quoted Jo Cumbo in a recent piece on USS:

“Questions now hang over how hard other scheme actuaries and professional trustees have pushed back against the regulator over a valuation ….”

On transfer values which “go up” when total asset values “go down”, however, I tend to blame DB trustees for using volatile short-term assumptions instead of using less volatile long-term assumptions, and for once the Pensions Regulator’s guidance on transfer values is very clear:

“As from 1 October 2008, it is the responsibility of the trustees to take the decisions on which the calculation of cash equivalent transfer values (CETVs) is based. Previously, the calculation had to be certified by the scheme’s actuary as consistent with a professional technical standard.

….

“It would be reasonable for trustees always to review assumptions at the same time as a scheme funding valuation.

….

“One of the permitted reductions is to allow for the funding situation of the scheme. However, trustees may only reduce [initial cash equivalents for transfer value purposes] for this reason after obtaining an assessment by the actuary of the funding of the scheme using the transfer value assumptions and known as an ‘insufficiency report’.”

Thanks George – there is of course rather more capacity for actuary’s to use discretion than is currently supposed.

Time for tPR and FCA to work out a joined up policy?

This time you really hit the nail in the head Henry! Instead of claiming advisors who charge non-contingent fees, and who are in this business only for the money (there were a few of those in 2017 with BSPS), the root cause for the transfers is the high CETV.

I think it will be good for the regulator, and some other people who comment on these issues to interview these people who transferred and the ones who will do it in the future to figure out what their exact motives were/are. Also, instead of presenting numbers like 66% have been recommendations to transfer for people who use these numbers to understand the self-selection of people looking for DB pension transfer advice.

Yes, in the first rounds the FCA has used it powers and checked on some firms which did bad advice and the unsuitability was high (I was an whistleblower on five firms myself). There were also some firms which did not do a good job of explaining why they advised to transfer, and it resulted in a high number of ‘unclear’ situations! I do not dispute these.

What I suggest is that the regulator looks now at the cases that it collected early this year from every firm, and present this data to the public, so we have a more balanced view of what happens.

People have a lot of personal things they care about when we do their discovery meetings. Some are willing to help their children on the property ladder, others would like to retire early and purchase a fishing boat, some want to spend a bit more in the early part of retirement, some even move countries. If these are planned correctly, and care is taken for their realistic retirement needs, transferring out is something worth considering, especially when transfer values are high!

You have to think the DB pension is the result of a calculation based on the number of years of service, final salary and inflation revaluation, it is not a result of a planning for retirement activity. Sometimes this is higher than needed, other times is lower. Transferring could give for some people a chance to attempt a higher retirement income by taking investment risk. For many the confidence interval is 85% or more. As long as they make contingent planning for the other 10% missing, they could be advised to transfer. (4% would be the PPF risk, and 1% is the systemic risk where capitalism could collapse, UK defaults, so you won’t be better off in a DB scheme either).

The existence of a contingent plan is important. For most this will mean equity release / downsizing, for a few wealthy – commitment of other assets. If they remain in the DB scheme, people will access the equity release tap well too early, and get the effect of 5% per annum, interest compounding. It is hard to stop people achieve their dreams, proof is the £4 billion+ per annum equity release mortgages taken out, approx. £28 billion in the last 10 years, and probably another £55 billion in the next 10 years.

Henry predictions based on short term considerations is not sensible. Economic data is very often restated some months after the data is published

The father of value investing, Benjamin Graham, explained that in the short run, the market is like a voting machine reflecting which firms are popular and unpopular. But in the long run, the market is like a weighing machine assessing the substance of a company.

Mark- to – market accounting means a company’s value rests upon last trade prices rather than the value that it stands to create over the coming years. One result of the interest rates adn bond market is the 40x emerging benefit transfer values. I believe that this system needs fixing.

The typical individual produces the bulk of his pension in the 15 years prior to taking benefits. That return has been in decline over the past 25 years.

A model, maturing 15 year pension on July 20th 1998 enjoyed a compound growth of 12.87% pa whereas one maturing on November 22nd 2008 was only 2.86% pa

A 15 year plan maturing on July 28th 2019 produced 8.59%

Since the Government has decided that the member has not only the promised income but also that the money in the DB fund belongs to the member if he wishes. The challenge therefore is to ensure the clients not only get the right advice but that the return compares well with the market. If they are to take market risk then the capacity for loss needs to be fully understood by the client

I wonder what the IRR of an annuity is these days?

If the adviser follows the guidance from the FCA see link

However the mortality of the schemes in your own column has been said to be a concern. If we do have only 1000 DB schemes left in ten years from now can the PPF cope with another 5000 casualties?

https://www.fca.org.uk/news/news-stories/fca-publishes-video-help-consumers-understand-pension-transfer-advice

I do not think Henry referred to casualties, but to consolidations and buy-outs. There would casualties too, as not all businesses last forever!

The financial advisor recommends what is suitable for the client. We cannot dictate to clients or impose paternalistic views on them, we need to offer solutions to them.

Two years ago the FCA was nearly to remove the guidance that the advice need to start from the opinion that a transfer is not usually in the interest of the clients. Now, after some bad interaction with the WPC it changed the tack slightly!

Good to see DB pensions proving their worth.

In the BSPS2 annual deferred benefit statement dated May 2019 I noticed there was a substantial increase in the ‘Indicative Transfer Value’ compared with the previous statement dated June 2018. This is still below the CETV I had from the old BSPS in October 2017.

If there was a crash or prolonged downturn in the markets I wonder if the BSPS2 ‘Indicative Transfer Value’ would surpass my original CETV from the old BSPS?

As you say Henry…..”transfer values can benefit from market crashes, as money is swiped into gilts, pushing down gilt yields and increasing the price at which gilts need be purchased”.

Robert, if you intend to take benefits from the BSPS2 scheme, the transfer value makes no difference for you.

What will happened to gilt markets is up there in the air. They could go to 0% per annum, or even slightly negative! There is a point when no one is investing int them anymore – people do not like to have a guarantee they lose money!

As you probably have heard already, TSUK (the sponsoring employer for BSPS2) is looking to arrange a buy-out for the BSPS2 (this is information from the accounts). There are quite a few insurers looking at this ‘opportunity’, and I am told Pension Insurance Corporation (PIC) is in poll position given their easier way to raise capital to comply with capital adequacy provisions.

When this buy-out will happen, the transfer values would be calculated using the insurer’s methodology, and all other factors for early retirement and pension commutation would most likely change. I have dealt with PIC a few times, and I could tell you transfer values tend to be reduced after a buy-out. Also early retirement factors and commutation factors tend to become not that good as before. It may not be PIC, but I do not think other insurers are better when it comes to early retirement and pension commutation – they are in this sector to make a profit.

There would be a consultation with the members, and you and other remaining members in BSPS2 would need to get some reassurances on these issues, as this is a pension scheme where very few intend to retire at age 65.

Eugen,

I intend to take benefits from the BSPS2 and I’m aware the transfer value makes no difference to me. However, BSPS2 deferred members who are more than a year under their normal retirement age (me included) have the option to transfer out if need be. I would only consider this in certain circumstances e.g. if I had serious health issues etc. If this was the case, the transfer value would make a difference to me.

The Trustee’s aim is that over time (as benefits are paid out and the Scheme matures), the BSPS2 funding level will reach 103% on the “buyout” basis and, if that happens, the assets of the Scheme will be used to secure benefits with one or more insurance companies, including restoration of benefits in accordance with the provisions agreed when the BSPS2 was established. In this scenario the Trustee does not expect there will be any surplus paid to Tata Steel.

On buyout, responsibility for setting the terms passes to the insurance company which include things such as how pension income is converted into a cash lump sum, transfer valuations and payments for those retiring before or after the scheme’s normal retirement age. These terms will usually be different to those available before, but they are often better rather than worse for most members.

The only members who may lose out are the deferred members whose early retirement and tax-free lump sum terms would most likely change but may also benefit depending on negotiations with Trustees. Each buyout is individual even though there will be common aspects. Insurance companies want to make a profit on the buyout overall, of course, but are subject to treating customers fairly when setting such terms.

A directive called ‘Solvency II’ which sets out how much capital insurers have to hold to back their liabilities was introduced in 2016. Under these rules, insurers are required to closely match liability and asset cash flows in line with strict rules on ‘matching adjustment’ eligibility – something that made the underwriting of non-pensioner liabilities much more challenging. Yet, insurers are now getting to grips with what pricing looks like for deferred members, meaning they are now able to offer better terms on buyout pricing.

Insurers now understand how Solvency II works and what can and can’t work in terms of assets and they have found a number of assets that work very well for pension schemes that have deferred members.

There is also a possibility that the BSPS2 Trustees may decide the fund is performing so well, they would seek approval to continue without sponsor i.e. no buyout. Benefits would be given after April 2021 and further growth over the subsequent years used for member benefits only.

Whichever way it goes, BSPS2 members would need reassurances on these issues.