We all know who will really bear the cost.

Lots of good things came from yesterday’s rant against the burden the Governments’ proposals for auto-enrolment would impose on those on low incomes.

Is the purpose of extending auto-enrolment to cut back on the state pension? @henryhtapper says it is. https://t.co/S4Dyyhp4qk

— Paul Lewis (@paullewismoney) December 18, 2017

When Paul Lewis talks , people listen. He does understand the way the low-waged have been disadvantaged and has championed their cause.

The IFS have produced an excellent document that comes to the conclusion that these reforms will bear hardest on those with least available income, those who are young and those on low earnings.

Another person who has focussed on the financial issues of low-earners is the Ferret, Gareth Morgan, who wrote this eloquent and justified rebuke to me and other “financial educators”.

Here’s what I had written

“Why don’t low earners get savings incentives?

…. blogs have shown, a high proportion of those auto-enrolled with earnings in the £8-12,000 range are contributing to workplace pensions without getting the promised government incentive (equivalent to tax-relief).These people will see their minimum contributions increase by 500% over the next two years, but they will not see this blow cushioned in any way by the incentives enjoyed by higher earners.”

Here’s the Ferret

In many cases they do get incentives. I’m constantly disappointed that most financial services professionals show such little knowledge, and even less interest, in low paid and poor people. For an industry that keeps telling us that their main concern is professional standards and financial education there us a surprising correlation between their expertise and focus and people’s prosperity.

If you are earning between £8k-£12K then you are more than likely to qualify for an in-work benefit. Either the new Universal Credit or the legacy Jobseeker’s Allowance or Working Tax Credit. If you get UC then for every pound you pay into a pension your benefit will increase by 63p, in cash, in the following month. This is because 100% of your pension contributions are disregarded in the means test. That means that the income on which the assessment is based is reduced and your benefit increases.

For JSA 50% is disregarded , so you get back 50p and for WTC it’s 41p.

In general you’ll get JSA if working less than 16 hours a week; WTC if you work over 24 hours (and have children) , 30 hours if you don’t.

Most people working between 16 and 24 hours lose out on benefits and get no credit for their pension contributions.

I’ve frequently said, that pension providers bizarrely ignore this when promoting schemes but the same is true of government and other bodies too.

What Paul and Gareth do is based on their DNA which doesn’t treat rich people any differently from poor people. That is why when I speak to them, they do not appear patronising or aspirant. It is a great gift they have, that they are neither chippy or subservient, they treat everyone as they come – without grace or favour.

What Gareth “the Ferret” actually does

I mailed Gareth to thank him for his comment and he sent me back some details of the services he provides to employers who want to understand their low paid staff’s financial position.

I omit the totally unnecessary (and well meant) apology to me for giving me a kick in the arse. If you are reading this Gareth, I thank you for kicking me out of my complacent ignorance! Here’s the meat of his message.

I have been trying to make the point for a long time (here’s a 5 year old piece from my blog http://blog.cix.co.uk/gmorgan/2012/08/31/pension-subsidy-in-universal-credit/ which gives a bit more detail – although now the figures are out of date of course).

Our benefits advice calculators do the relevant sums as part of the entitlement calculation.

While I wouldn’t expect financial advisers to be doing benefit sums generally, it would be simple to do this with our pensionForward system. Although this is focussed on the effects of using pension pots on tax and benefits, it also does the basic benefit sums which include the contribution disregards.

I’ve attached a bit of blurb about the system, but if you’d like to point people at http://www.ferret.co.uk or http://www.ferret.co.uk/solutions/finance/ , that would be very nice of you.

It’s not hard to promote Gareth Morgan – in fact it’s a pleasure!

Qualified Independent Financial advisers have limited resource; they only have themselves and the advice model is one to one. They cannot adequately advise, using their toolkit, those on low incomes, not because of skills (they have them) but because of time and money. Advisers cannot afford to work Pro Bono for ever.

It is not bizarre that IFAs can’t advise those on low incomes; their business model works on 80;20 – that means you kick out the 80% of enquiries which won’t make you money and focus on the 20% that will. That means focussing on the wealthy or , to use Gareth’s felicitous phrase

a surprising correlation between their expertise and focus and people’s prosperity.

But I think Gareth may be ferreting down the wrong hole . It is firms like mine that he needs to be talking with- (and Government)

We (First Actuarial) aim to help large employers become more productive by improving financial well-being. Our market is precisely that which wealth-managers discard, the 80% of people who have no need of wealth management and advice but do need guidance.

There are many firms that we would like to provide this work to , which rely heavily on low earners. They include household names like Tesco, Marks and Spencer and Asda. A few years back Morrisons did invest in helping their staff and I wrote a lot about its Save our Dough campaign. But for all the good sense of Alvin Hall, I never saw him do the work that Gareth Morgan has done (with his benefit advice calculator).

Is there a business justification in this?

As a businessman, I do not employ people on low incomes, I simply don’t run that kind of a business,

But i have worked on a low income and had to rely on it and I know how important my employer was to me. I depended on my boss to get paid but also to help me out with advice about benefits and housing and a lot more. I was young then and now I am able to return that help – not to my staff – but to those of other businesses.

My conversations with Wendy Taylor (then head of pensions at Morrisons) helped me understand the value that businesses like theirs put on the people who work on the tills, stack the shelves and manage goods in and rubbish out.

Alvin Hall – a financial educator for Morrisons

There are many other large businesses (for instance in facilities management) , where the labour force is principally low paid and part time. The public sector, especially the NHS, relies on low-paid part-time workers.

The business justification for helping low-paid staff understand their state benefits, their employee benefits and their income through the calculators that Gareth produces is obvious.

The link between financial well-being and productivity is proven. The opportunity to be an employer of choice for the people who can be productive is obvious. Those businesses who can make the lives of their low-paid workers better, will not just get a short-term boost in output, but build a brand around good industrial relations.

Back to auto-enrolment

It is becoming clear to me , that Government pension policy is about the rich telling the poor what to do. It not only misunderstands the needs of low-earners, it treats low-earners as a commodity to be exploited.

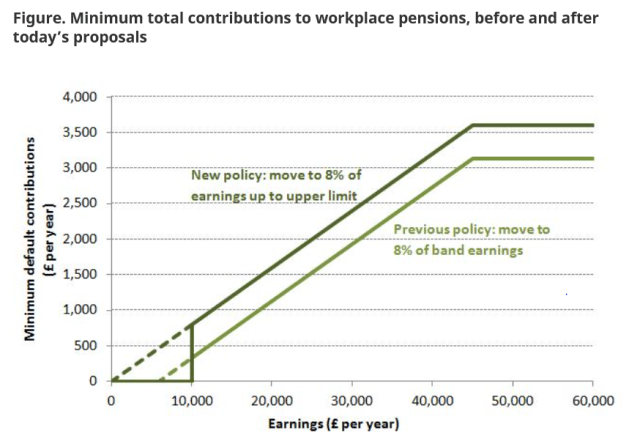

Reading through the pages of the auto-enrolment review, the logic is flawed. Just because low-earners and the young (often the same) , have succumbed to auto-enrolment, does not mean their acquiescence should be exploited. To compound the financial strain of April 2018 and 2019 which will see minimum contributions rise by 500% by a further doubling of contributions some time in the mid 2020s strikes me as financial cruelty.

This brutal imposition of pension costs on the low-paid has been welcomed by the financial services industry, small wonder – we stand to gain and not to pay.

But if the price of being “in” is as high of 8% of your tiny earnings, this price may be too high.

People on low earnings should look forward to a “high” state pension (relative to others) because it replaces more of their earnings. The financial pay-out will be the same, but the replacement ratio of the State Pension to poor people will be higher.

Why then force those on low incomes to save so hard and why give them so little incentive to save through direct saving incentives?

Why create a system of credits that is so complex we need Gareth’s help to understand who gets what and who will benefit from paying what by way of pension contributions?

My conclusion is that the pension needs of those who earn least are least understood and that Government should be spending more time on these things and less time on vanity projects (especially the pension dashboard).

The Government should invest in Gareth Morgan- aka the Ferret. They should make his work universally available to employers – whose low-paid staff need Gareth’s benefit calculator more than they’ll ever need a pension portal.

The Government should also study a beautiful document produced this week by Legal & General called “The good, the bad and the unexpected lives of UK pensioners”. That might help them refocus on what pension saving is all about.

Financial fairness for all

The Government seems intent on increasing the scope of auto-enrolment to include the lowest paid and the youngest of our workforce. I can only conclude that they are intent on reducing dependency on state benefits over time.

But the reason we have state benefits is because we have a welfare state that looks after those who cannot become wealthy. For whatever reason for this, the Government must not look down on these people. They cannot look down on the poorest earners.

We are coming up to Christmas, the most important thing I did for myself last year was to spend time helping at Crisis at Christmas, it taught me and i hope it gave some people a better Christmas.

As with Paul Lewis and Gareth Morgan, there is nothing patronising about Crisis , it helps less fortunate people in practical ways – as business as usual.

Financial fairness is not something that needs a special campaign, it should be baked into our DNA. Right now , I see the financial services industry as Gareth does, focussing on prosperity. We need financial fairness for all and that may mean refocussing on those on whom our prosperity depends – those doing the hardest work.

Gareth Morgan – the Ferret.

Apologies for the David Morgan references, i know three Davids and only one Gareth – blog should be “David free” now!

Many thanks for this Henry. We’re always very happy to talk to anyone who’s interested in improving services to people but especially to those who tend to be overlooked (or ignored).