Ros Altmann, who writes better than any financial commentator I know, has produced a brilliant blog on the differences between investing in a property and investing in a pension.

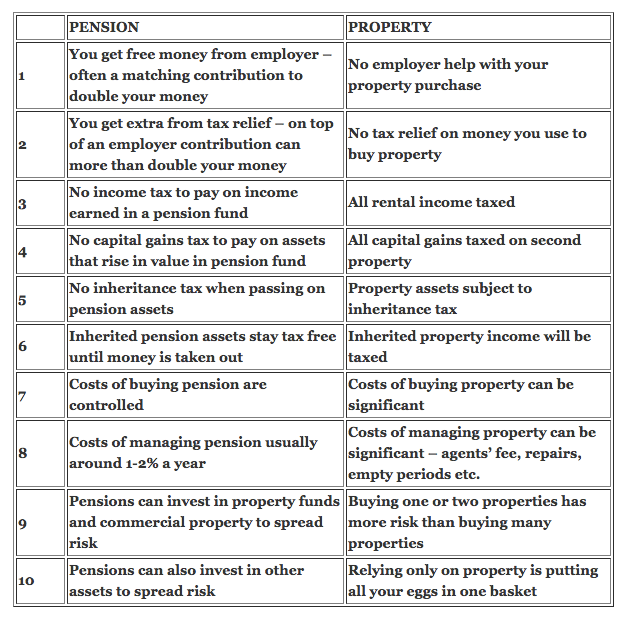

You can read the blog here, this is the key table.

But!

I think Ros is preaching to the converted!

The problem that people see with investing in pensions is not what they are told, but what they cannot see.

Property is a direct investment, you are involved in the physical purchase, you manage the physical asset, you control every bill that is paid to maintain the property, you receive the rent – often directly from the tenant.

In short; you need to trust no-one but yourself.

Trusting what you see, what you smell, what you feel

Trust is in very short supply and diminishes fast, the further you get from being a part of the financial markets. The person who manages my pension, who runs the Multi-Asset Fund at LGIM, is someone I can have a coffee with. I know him, I trust him – I know how he works.

But if you live in Bolton or Plymouth, if you and your family are new to Britain, if you left school when you could , if you have difficulty reading … if you are on the margins of the intelligentsia that manage wealth through funds, you trust no-one.

This was the most important lesson from the time I spent selling insurance to people who knew nothing of financial markets. They trusted in nothing that they could not touch. Better a smelly, rodent infested, damp basement in East Ham than the promise of a financial salesman like me. The only sale I could make to many people I talked to , was access to the debt they needed to purchase the house they lived in.

The village

I still see some of these people- mainly the Turkish Cypriot friends I made in Green Lane in North London.

Many are now property moguls,owning streets not houses. They have learned about capital gains tax and are now worrying about inheritance taxes. They have accountants who have shown them ways to manage their liabilities using company structures. Some of these people are now lending money into their own communities to enable their extended families to get their feet on the ladder.

The village is a particularly important part of this. Especially in Asian communities, the village you came from, is the village where other people in your area came from. It is somewhere you aim to get your family out of and to which you send money in the meantime. When you live in Britain, you support those in your village.

And the system of support is what we used to call a mutual society. It is often very informal and depends on the familial bonds and the trust that has grown up over centuries.

The City

One of the things that happens over time is that people like those who I first met in the early eighties, have children and grandchildren and those kids and grandkids learn not just the ways of the village but the ways of the City. The City of London is packed with brilliant young people who grew up in the properties that their parents and grandparents bought now fifty and even sixty years ago.

These are the people to whom Ros’ table makes sense. When I talk to Ros, I see the very person I am talking about. When she talks about her grandparent’s shop in Tottenham High Street , I see her there, because we have walked past it on the way to White Hart Lane. I used to eat in the Starburger in the Seven Sisters Road and went to Shenola night club in Hackney Marshes.

I saw kids growing up who are now running London, running the Capital Markets and holding senior office. Look at Sadiq Khan. Born in Tooting, South London to a working-class British Pakistani family, Khan gained a degree in Law from the University of North London

Including the excluded.

I was in the queue for security to get into the House of Commons yesterday afternoon. Behind me were two elderly Australians. I heard one say to the other,

“I bet you don’t get many Moslems in here”.

I smiled when I saw them being frisked by two young Moslems, one male, one female.

What Ros Altmann does, and does better than anyone, is speak right to the people who are moving from the Village to the City. She helps people to understand how the ways of the past need to move on so that our society includes the Village.

And I mean this too for working class indigenous Anglo-Saxons, who we are in danger of alienating in this process. Ros speaks through the Mail and the Express and she speaks directly to those on the margin who are trying to get on.

The words of Theresa May about those “getting by” are still ringing in my ears. I don’t want people to be made to feel “ordinary”, I want people to aspire to more than being a Landlord, I want them to have financial freedom and to be a part of Great Britain.

Ros is helping manage that process from the Village to the City. She is doing it as only she can, using her great skills with words and her deep understanding of that journey.

I urge anyone who hasn’t read Ros’ article to do so, it is deeply truthful.

Agree, Henry, we shouldn’t just buy in to

Lady Altmann’s defence of the pensions status quo.

Disagree, Henry, that most should trust no-one but themselves. That may explain reports that around a third of larger recently transferred pension pots are being vested in cash.

For many, prudent trustees are what are needed to make better decisions on their behalf after weighing advice.

One significant advantage of buy to let, which Ros Altmann leaves out, is the leveraging that is possible. Here I quote from this :

“4. You can leverage up your property investment

…[If you have a £50,000 deposit, a] bank will lend you [£150,000 for a sum total of] £200,000 to buy a house at an interest rate that’s just a smidgeon above inflation.

Just try getting the same deal from HSBC to buy a high-yield share portfolio – despite the fact that currently the dividends would cover the repayments.

‘Leveraging up’ like this makes a massive difference.

If I invest £50,000 into shares and the stock market doubles, I have £100,000 and have made £50,000.

If you invest £50,000 into a £200,000 house and the price doubles, your house is worth £400,000 and you have made £200,000, after backing out the mortgage.

Yes I know houses are more work, and need maintenance and whatnot. The point still stands. Taking on debt has multiplied the return from property several times over.

Most of us don’t work at hedge funds, and will never get access to cheap debt to gear up our stock market investments like we can with property.”

The URL for the post from which I quoted above didn’t show up above. For the sake of credit where credit is due, it’s a Dec 20, 2012 post by “The Investor” from his “Monevator” website, entitled “10 reasons why houses are a better investment than shares”.

http://monevator.com/10-why-houses-are-a-better-investment-than-shares/

I am sure we are all aware that gearing not only increases reward, it increases risk.. So long as an investment is guaranteed to go up, why not borrow to multiply your gains! But who provides that guarantee? I remember at the end of the 25 year bull run on the stockmarket in 2000, a lot of people had borrowed to increase exposure to shares- how did that work out?

I see both your point and Mike’s. The lack of a level playfield with pension is a pain. People like tangible assets. That is to a great extent what Islamic finance is all about trading of REAL assets fairly, no smoke and mirrors, no slight of hand. Pretty much the “village” mentality.

As a small firm in South East Kent, Thanet used to be an Island and along with the other towns I worked in (Deal a former mining town and Dover the Ferry town, now a skeleton) have the village mentality you refer to. It is HARD work to persuade people about the value and importance of pensions and having been heavily involved in group pension business between 1998 and 2005 (pre and post stakeholder) we always said that what was needed was entry by default (i.e. auto enrolment). I am pleased it is now here, even if it’s not what we can do easily now for smaller employers and their staff and make it costs effective.

Part of the battle is now to point out, as Ros is doing, that a pension is a tax wrapper and NOT an asset class, while property is an asset class and NOT a tax wrapper.

Lastly, commercial property CAN be held in a pension fund as we all know and whilst that may mean over exposure to one asset class is still a consideration, especially for businesspeople looking to buy their premises anyway.